04May12:05 pmEST

On Track to Break Bad This Summer

Although it has been sacrilegious to suggest it, the failure of bonds to sustain an oversold bound of late does indeed constitute at least some change in character, compared to what we have seen for a while now.

After I sold my TBT long last week (an ultra-short ETF targeting the likes of TLT), I expected at least some type of bounce in bonds before another potential short entry.

But, simply put, that has not happened, despite flipping to green on Thursday.

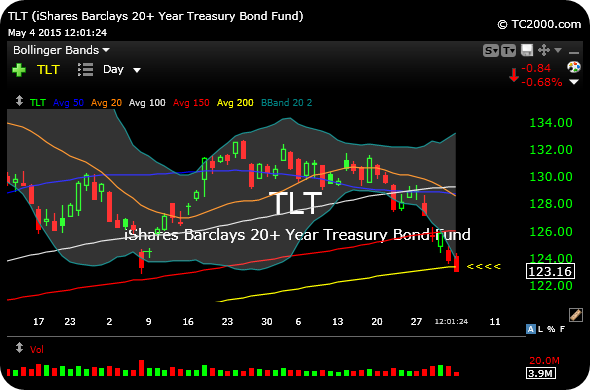

On the updated TLT daily chart, below, now how price has been "riding along" the lower Bollinger Band, indicative of mildly oversold conditions. Failure to hold a bounce from oversold is typically considered bearish.

True, the 200-day moving average could easily bring out some buyers. But bounces are being sold, is the main point, even from oversold conditions.

As far as how weak bonds this summer could influence equites, I doubt it will have much initial effect on the like of EXAS or ISIS in the healthcare/biotech space. For now, I am looking at bonds on a standalone basis, and will let the market dictate the correlations going forward without assuming anything.