02Sep2:55 pmEST

End of Summer Jump

Si

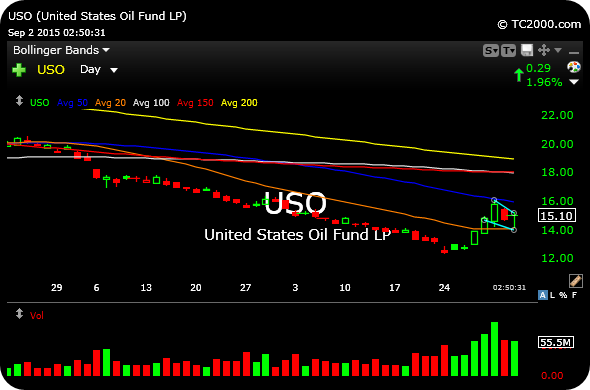

Crude oil flipped green this afternoon, after sinking soundly into the red this morning following-up on yesterday's drubbing.

Black gold has worked off its overbought condition from Monday, and is now threatening a secondary counter-trend rally. Much like surviving coal names like ACI and BTU, bottom-calling bulls are looking to see a scenario where shorts are trapped in and not given breathing room to cover.

As such, any shakeouts should be abrupt, violent, scary, but ultimately short-lived, which is what we have seen from ACI and now crude, thus far.

I suspect a move over $15.60 on USO sees another jump up, while below $14.10 (20-day moving average, orange line, below) likely now needs to hold in order for crude bulls to end the summer on a respectable note in light of the pounding they took this year.

It's Supposed to Be a Non-Co... Stock Market Recap 09/02/15 ...