17Mar12:55 pmEST

It's a Winston Wolfe Bull Market, You Know

A hidden, subtle issue about the rally in commodities in 2016 may very well be that sugar, of all things, led the complex down since 2011 in a very pronounced manner, in a potent downtrend, before bottoming late-last summer.

After sugar bottomed before Labor Day 2015, it then made a meaningful higher swing low, which we profiled in real-time here and for Members, earlier this winter.

Since then, commodities have gotten a bigger lift, with even the worst of the worst in the soft commodity complex rallying.

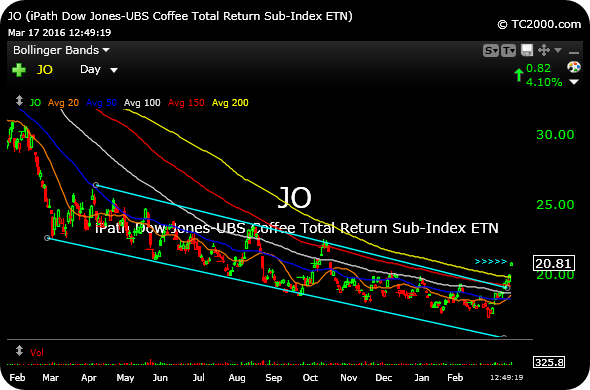

Coffee, for example, the perennial heartbreaker that it is, finally broke a very steep and very well-defined falling channel higher, seen below on the JO ETN daily timeframe.

To be sure, we have even more work to do to confirm any type of new bull commodity super cycle.

But with sugar gapping up again today (SGG ETN, for example), the thesis that sugar is a stealth leader for all commodities would seem to carry a bit more weight these days, especially with some of the pronounced rotations taking place in the global materials and mining complex.