23Jun10:52 amEST

Hitting Targets on the Nose

We have the good and the bad this morning, into a pre-Brexit result gap up in the broad market. Two names we have mentioned for Members as having no clear trend the last two years, in the leaders' category, may be going separate ways now.

On the one hand, Tesla Motors is back down to the $195 support level we had previously analyzed. On the updated weekly chart, first below, you can see as much, with TSLA likely needing to hold here this summer to avoid an avalanche breakdown, crushing the many momentum longs in the name still betting on a new sustained leg higher. Clearly, seeing SCTY given up all of its Musk "buyout bid" gains earlier this week is not helping the cause for TSLA bulls, either.

But, ultimately, beyond corporate governance issues I suspect the $195 levels will tell the real story this summer as to whether TSLA is merely consolidating, still, or ripe for a major breakdown.

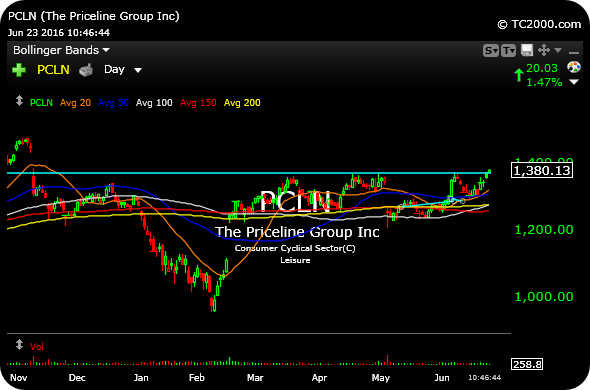

And on the bull side, PCLN pushed over $1370 this morning, a level we have been observing for Members for quite some time. The issue now is whether buyers can hold above that breakout level, a previously arduous task.

Still, Priceline made new multi-month highs today, which is a claim most leaders cannot make in this tape of late.

Stock Market Recap 06/22/16 ... A Judgement-Free Zone About ...