28Jun1:13 pmEST

A Gothic Take on the Euro's Structure

If you like to think in terms of risk-to-reward, the notion of the Euro potentially becoming extinct should at least be entertained (if only to then be dismissed for a variety of reasons).

But if the Brexit vote is categorically not an isolated event, and in fact sets off a chain reaction of other EU member nations seeking to exit, the Euro's future becomes suspect and it is hard to see how it would inspire much confidence in the currency even if it does waddle through the dramatic votes.

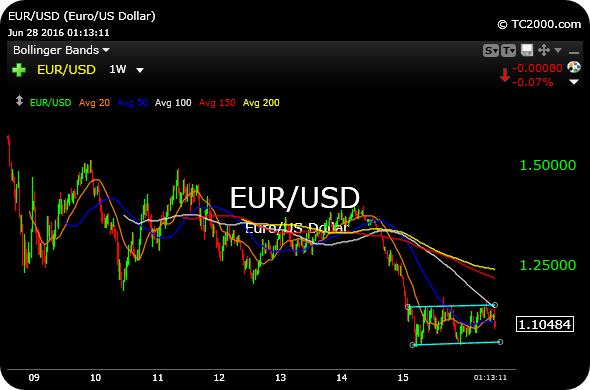

With this in mind, it is worth noting that the Euro/Dollar currency cross, for example, remains in an overall bear market, seen below on the long-term chart. Many have assumed the dead money period of the last eighteen months or so has amounted to a bottom. However, the consolidation may simply be setting up a new, sharp leg lower as systematic risks to Europe begin to become increasingly pronounced and gain attention after being trivialized as hyperbole for years.

I view 1.10 then 1.05 as some levels of note below to reach parity, before we can even begin discussing some longer-term considerations about the Euro.

Euro bulls have had more than enough chances to confirm the highlighted 18 months of basing as a true bottom, and yet they failed time and time again despite making vocal proclamations of the bull case still being alive and well. In light of the Brexit vote they may now have run out of time.