26Sep10:53 amEST

A Lehman Event...or a Layman Event?

The nagging weakness in Deutsche Bank may finally be coming home to roost, for some type of "Lehman Event" central to a major bear case.

However, it is worth noting that when Lehman was allowed to go belly-up by Goldman-turned-government rival Hank Paulson in September 2008, the major indices, as well as most sectors and stocks, were already in established bear markets, and had been so for several quarters.

Here, we have most major averages still not far from all-time highs, even with this morning's weakness. So, that in and of itself is a notable difference in terms of whether DB can wreak systemic risk havoc in the same manner Lehman did when it failed. And, of course, there is always the issue that DB will not fail, and instead is nearing a major bottom.

The counter to the above argument is that the Brexit sell-off we saw in late-June is indicative of the hidden Black Swan risks in the current global economy, since it is extremely rare to see ES futures swoon limit down from a stone's throw of all-time highs, as we did after the "Leave" vote prevailed.

As you can see, the back-and-forth amounts to a heavyweight prize fight, with each side landing blows and the net result, thus far, is a near-term indecisive market albeit one near recent highs.

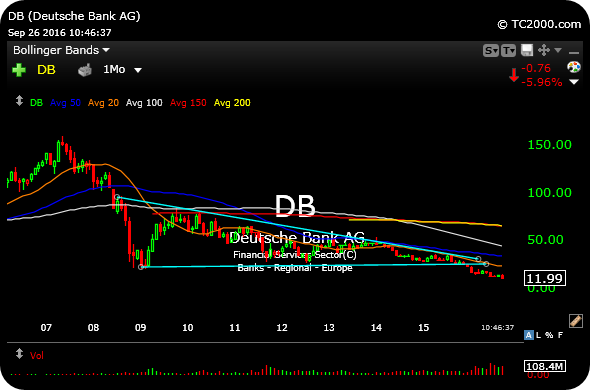

On the DB monthly chart, below, clearly the globe European bank has issues, pushing fresh lows this morning. This $12 area ought to be considered the last line of defense by bulls before we perhaps start to see some true panic set in--The bank, after all, has been grinding down fairly orderly of late.