25Jan10:46 amEST

20,000 of One, Half a Dozen of the Other

The Dow 20,000 milestone has finally been achieved, putting to rest what is otherwise a seemingly trivial event for traders. Nonetheless, the media coverage should now let up and, surely, has plenty of other material on which to focus going forward.

As for us and what we are left to negotiate in this market, bulls continue to trap bears as best and often as they can. We have been advocating a highly tactical approach to any and all shorts for Members for a while now, fortunate to pick off the QCOM downdraft in recent sessions.

But, mostly, the issue now will be whether some of these breakout moves can stick. Without question, this will be a better measuring stick of just how bullish this move above 20,000 is, beyond surpassing a large, round number.

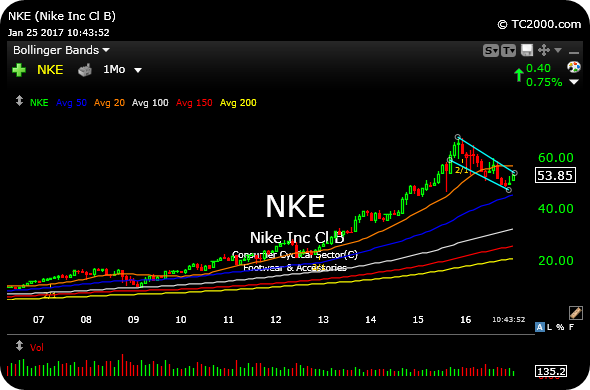

Speaking of the Dow, I return to a relative new component, Nike, which already reported earnings this season.

On the updated monthly chart for NKE, below, the multi-quarter falling channel consolidation may very well set the stage for a new leg higher on a long-term basis. Bears will counter that this type of action since 2015 amounts to a long-term topping process.

But either way I am willing to bet the outcome of this particular chart will prove to be far more telling about whether the market goes this year in lieu of the Dow crossing 20,000.

On a shorter-term trading basis, NKE holding above $54 has me looking for a long.

Stock Market Recap 01/24/17 ... Most Roads Lead to Inflation