08Feb10:25 amEST

Excuse Me, I Believe You Have My Staples

On a morning where biotechs as a group are trying to fight off a vicious Gilead post-earnings gap down, the small caps in the Russell 2000 Index continue to push lower.

For a while now, one of the more defined risks for a broad market pullback or correction in the winter months has been the underperformance of those small caps. And that is all the more pronounced this morning, with the much larger cap names attempting to hold inflows.

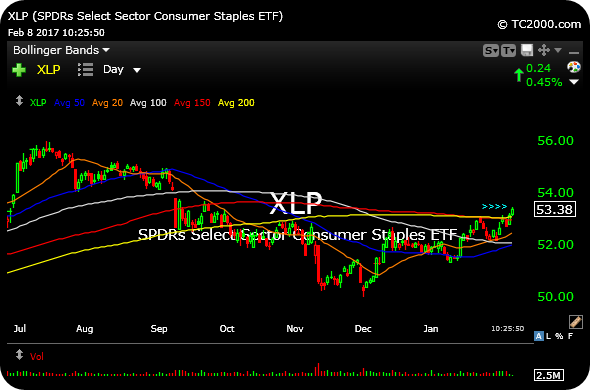

Specifically, the consumer staples housed in the XLP ETF are acting as well as they have in months. Tobacco stocks like MO PM RAI, and household item names like CHD CLX KMB are notably green here.CHD and CLX (makers of condoms and bleach), for example, are back above their respective 200-day simple moving averages for the first time in months.

Also note that Treasuries are finally bouncing consecutive days in a row, meaning rates are edging lower. This type of action can often benefit stapes, too.

On the XLP daily chart, below, just as with CHD CLX we are looking to see whether this move above the 200-day (arrows) can hold through February. If so, it should offer up a decent trade. I am not so sure about long-term swings, though, as I suspect the bounce in TLT may have a reckoning come springtime.

But in the meantime, to keep things simple, money is flowing to the bigs, away from the smalls.

Stock Market Recap 02/07/17 ... A Slow Motion Battle on Two ...