04Apr10:40 amEST

A Silencer on NVIDIA's Pattern

NVIDIA's cutting edge technologies have been rewarded by the market for a good while now, notably since February 2016 with an exhilarating rally helping to spearhead the leadership in the semiconductor sector.

NVDA's chart became rather steep to the upside late-last year, prompting us to look for signs of an exhausted rally. However, as winners often do in markets, NVDA refused to give back very much relative to its prior advance. We never really considered a short in NVDA outright, inside Market Chess Subscription Services, due to the viable threat of a buyout at any moment by a larger technology player. Indeed, that buyout threat still remains very much in play.

However, we did want to key off NVDA for clues about market momentum sentiment, as well as sentiment for the chips as a sector (SMH is the sector ETF).

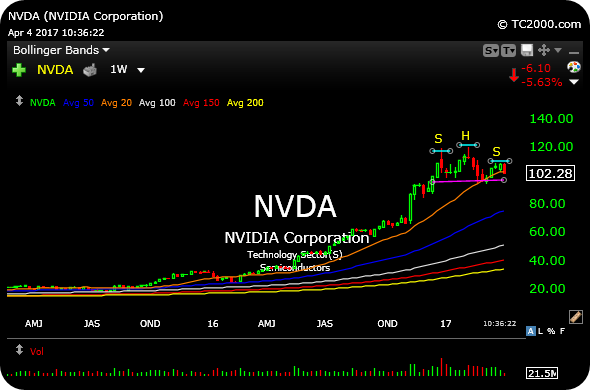

And when we do that, we see plainly on the updated weekly timeframe, below, that NVDA has gone nowhere since Christmas. Moreover, a potentially ominous head and shoulders top is now in contention, given the zigs and zags by price with no progress since late-December 2016.

If NVDA loses $95 now, I view the pattern as complete, projecting a move down $70 for a sharp correction, probably long overdue.

Again, I am not looking to get too involved with NVDA itself. But you can be sure I am keying off it for clues about momentum and the chips, especially with this pattern a rather quiet one given the time it has taken to develop in plain sight.

Stock Market Recap 04/03/17 ... Chesapeake Waking Up Just in...