20Apr10:47 amEST

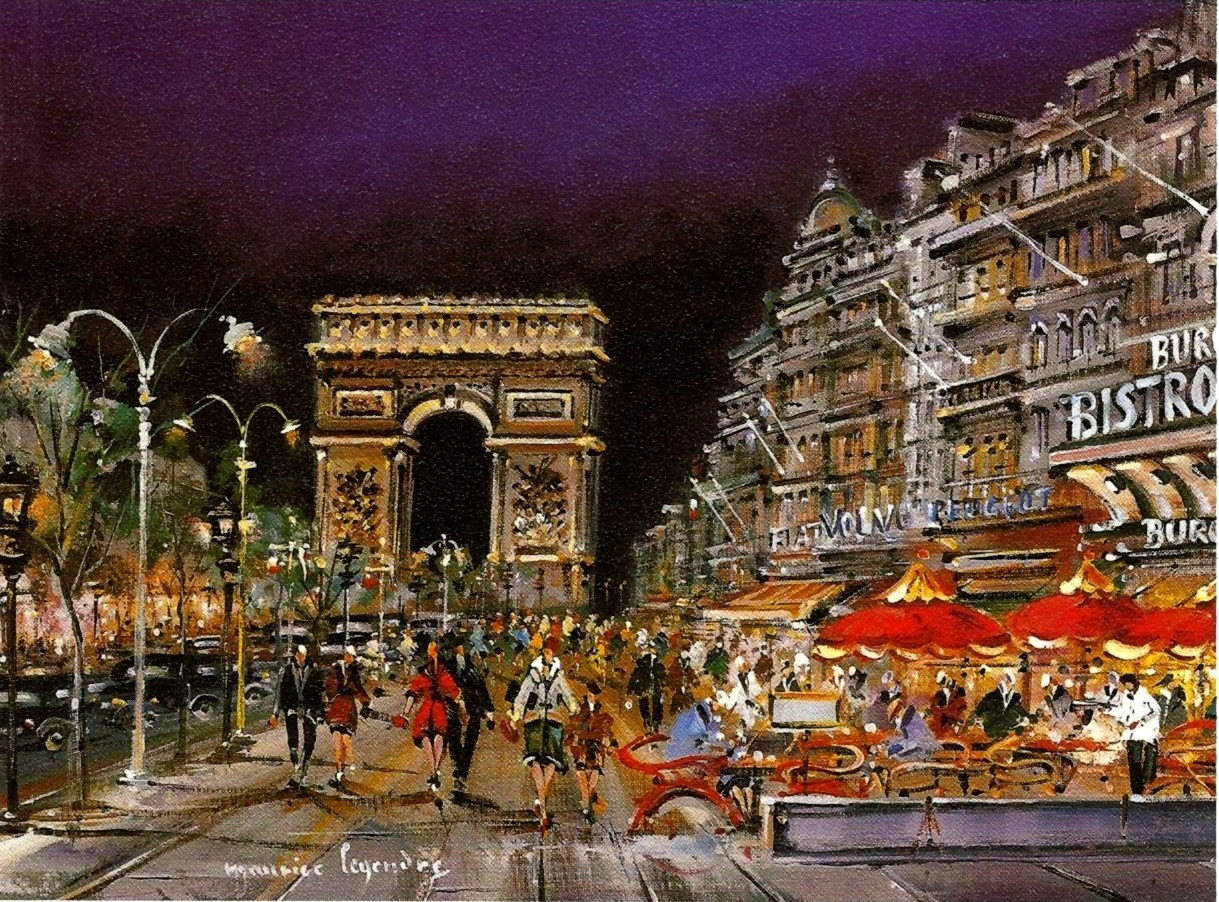

No Champs on the Champs-Élysées

In front of the French presidential election kicking off on Sunday, the major averages are still locked in a bit of a near-term stalemate.

Even with this morning's opening gap higher, for example, buyers cannot quite reclaim the 50-day moving average on the small cap ETF, IWM. The S&P is putting in a mildly indecisive "doji" candle thus far, and the Nasdaq is certainly respectably higher but not shooting to new highs, quite yet.

Even though it may be what Alfred Hitchcock would term a "MacGuffin," the French election still may keep a lid on the market, coupled with us navigating earnings season one report after the next.

As for specific stocks, QCOM is giving up an initial earnings pop and is back to red as I write this. I would not be shorting the name here, but it is a stock we have shorted several times this year inside Market Chess Subscription Services. If QCOM sees a multi-day bear flag pattern develop into next week it will certainly be back on my short radar.

And Foot Locker is moving nicely after an upgrade this morning. Earnings are about a month away, and this name still has one of the best charts in an otherwise-lackluster retail sector.