05Jul1:23 pmEST

Biotech: Was That It?

There are two schools of thought about the recent surge into biotechnology stocks as plenty of chips and Nasdaq winners cooled off.

On the one hand, broad market and dedicated biotech bulls argue that the breakout was a long time coming, as both the IBB and XBI sector ETFs have been digesting and base-building their 2015/2016 corrections for a few quarters now. Thus, this camp argues the biotech rotation is sensible, healthy, and part and parcel of a bull market.

On the other hand, a skeptical view is that biotechs are inherently more speculative and risky, and seeing them finally rally is more of a contrarian sign of speculative fervor running rampant even as leaders in the Nasdaq finally crack. Hence, this camp argues that the biotech run-up is more of a sign of a market top intermediate or long-term, rather than some type of bullish development.

At the moment, both sides are likely still sticking to their guns as neither case has been effectively disproven.

That said, what we care about more here than making a "big call" is seeing whether the biotech rally, on its own merits, can hold. If so, then regardless of the above arguments it logically follows that there could easily be a new batch of actionable long entry points in the biotech arena this summer.

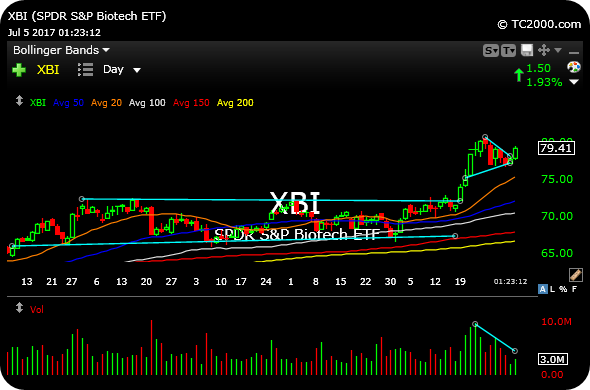

On the updated XBI ETF daily chart, below, the sector ETF for smaller and mid-cap bios is easily holding above its recent breakout over the low-to-mid-$70s. The price action over the last week, albeit during a summer holiday, featured light sell volume and is now threatening to resume the breakout today.

So the bull camp is saying, "Was that it?" in terms of the consolidation, meaning a new leg higher is in progress. And the bear camp saying, "Was that it?" in terms of the rally is now under a bit of pressure.

With this in mind, we will look at some enticing individual setups in this space for Members in my usual Midday Video.

Holiday Cheer Mixed with Fea... Stock Market Recap 07/05/17 ...