17Aug10:26 amEST

Late-Summer Bear Fun

After a sloppy open with an initial dip-buy attempt, equities are diving lower led by the small caps.

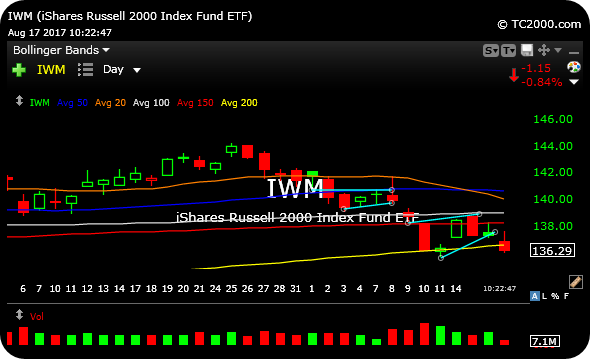

For a while now, we have been tracking the IWM, ETF for the small cap-dominated Russell 2000 Index, not arbitrarily or to cherry-pick, but rather due to the glaring divergence they presented vis-à-vis the senior indices.

That divergence figures to give bears a fighting chance for some late-summer fun this morning, as the IWM is decisively breaking its daily chart bear flag below the 200-day simple moving average.

It is still early in the session, of course. But this is the moment bears need to seize upon if we are to see a bit more corrective action into Labor Day. There are also some rumors about Gary Cohn leaving the Trump Administration, which could also serve to rattle markets in the near-term.

Finally, the manner in which equities are blatantly ignoring BABA's post-earnings rally is likely also another cautionary sign for now.

Inside Market Chess Subscription Services, we are hedged up and playing the rotations into the precious metals, looking to perhaps pick off another equity short or two.

It is far from a bloodbath out there. However, the major averages look to now have made lower swing highs as the small caps keep knifing lower. Indeed, that ought to be enough evidence to keep most new swing longs at bay.

Stock Market Recap 08/16/17 ... Citigroup's a Leader? Get it...