21Aug10:48 amEST

Headed South, Before Heading Out West

In front of the annual Jackson Hole Symposium at the end of this week, it is worth noting that the U.S. Dollar continues to operate in a strong, intermediate-term downtrend.

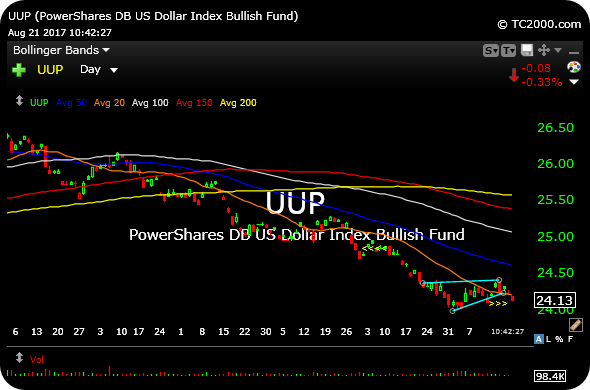

On the UUP ETF daily chart, below, which is simply the Dollar versus a basket of developed-economy currencies, you can plainly see the pattern of lower highs and lower lows by price, which actually dates back to December 2016.

Gold and some materials miners, despite the usual turbulence, have been taking some advantage of this Dollar weakness in recent weeks, as has the Euro and a few other currencies.

But it will be a defined risk for all of these asset classes headed into Jackson Hole, regarding how both Janet Yellen and ECB President Mario Draghi, also in attendance, will address (directly and indirectly) several issues pertaining to currencies, inflation, and even cryptocurrencies.

In the meantime, the Dollar is weak and looks to be breaking a bear pennant lower. Materials miners have another shot at taking advantage to push forward, precious and otherwise.

As for equities as a whole, some China plays are outperforming this morning again but as long as the major averages fail to bounce vigorously from oversold conditions it is tough to place too much faith in breakout plays from the long side.

Weekend Overview and Analysi... Will Jackson Hole Make You R...