04Feb10:45 amEST

Chop Suey Cafe

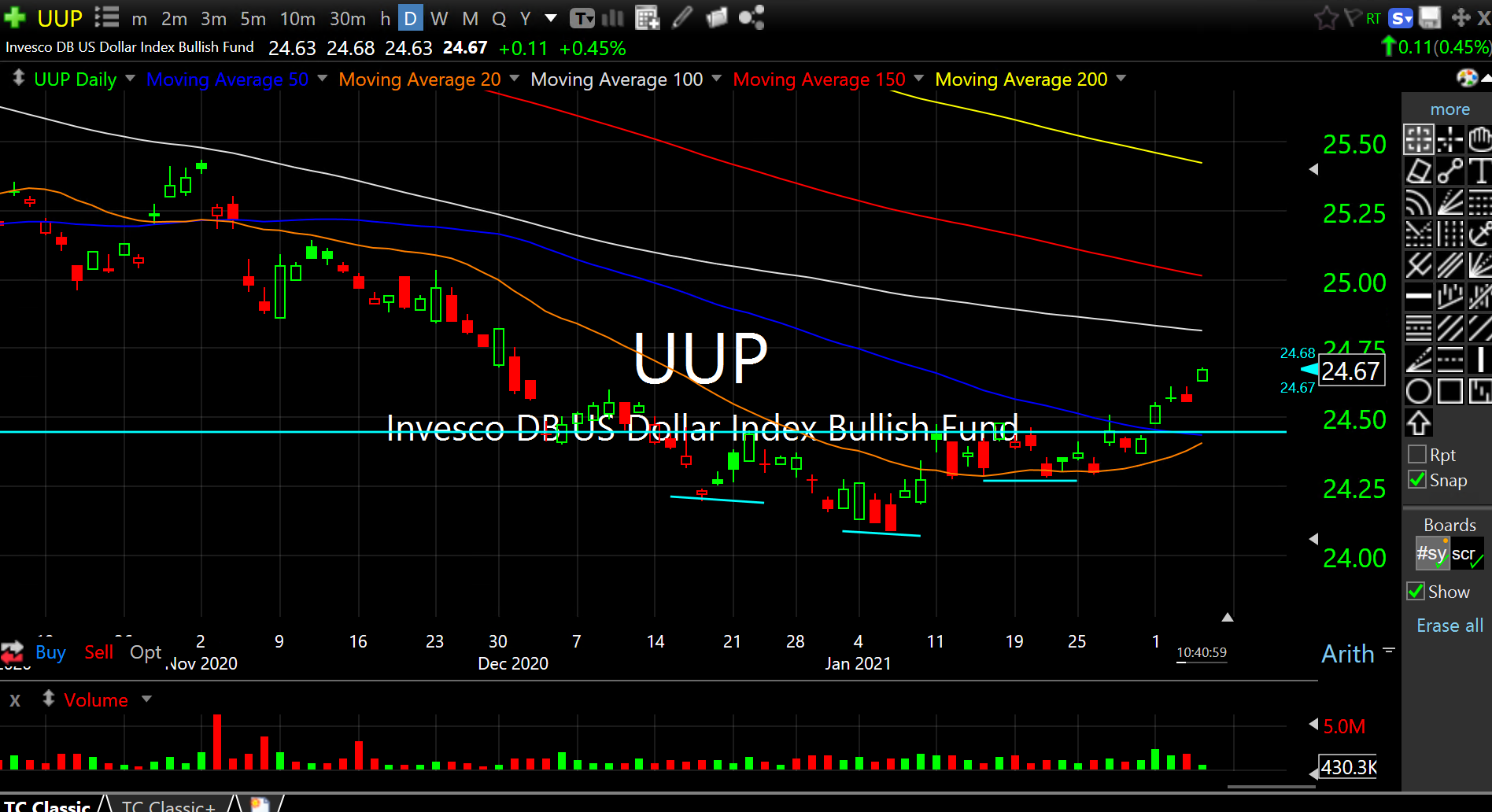

Impressive follow-through strength in the U.S. Dollar, whose ETF (versus a basket of developed economies' currencies), is below on the updated daily chart, may not be a factor for stocks in terms of inverse correlation. But it sure seems to be hitting gold rather hard this morning.

Another likely factor to the gold/silver/miner dump besides a strengthening greenback is the Reddit trade is unwinding, with the much-ballyhooed silver squeeze morphing into a squeeze alright--A long squeeze lower. Hence, freshly-minted (no pun intended) longs in the metals and miners are hitting the exit all at once.

To reiterate, longer-term the case for clueless Central Bankers continuing to debase the world's major currencies in lieu of allowing the full business cycle to run its course continue to form a study foundation for the metals and miners. However, as we discussed over the weekend with Members and back on Monday, too, the Reddit silver squeeze thesis was a totally different ball game than GME.

As far as equities are concerned, despite the Dow up 200 points as I write this, the action is focused on some of the smallest, highest beta penny-type names and those in the Russell 2000 Index. Meanwhile, the likes of TSLA and the chips are lagging, with QQQ only marginally higher as I write this.

The net result of the last week or two has been a rather choppy market, whipping around last week into the present. The Dollar's breakout, assuming it holds true, is still an imposing force and not something I take lightly. I remain long UUP and am looking to see where the tipping point is with a richly valued stock market.

Jeff Bezos to Us: "Good Luck... Stock Market Recap 02/04/21 ...