11Jul12:16 pmEST

On Tigers, Bulls, and Bears

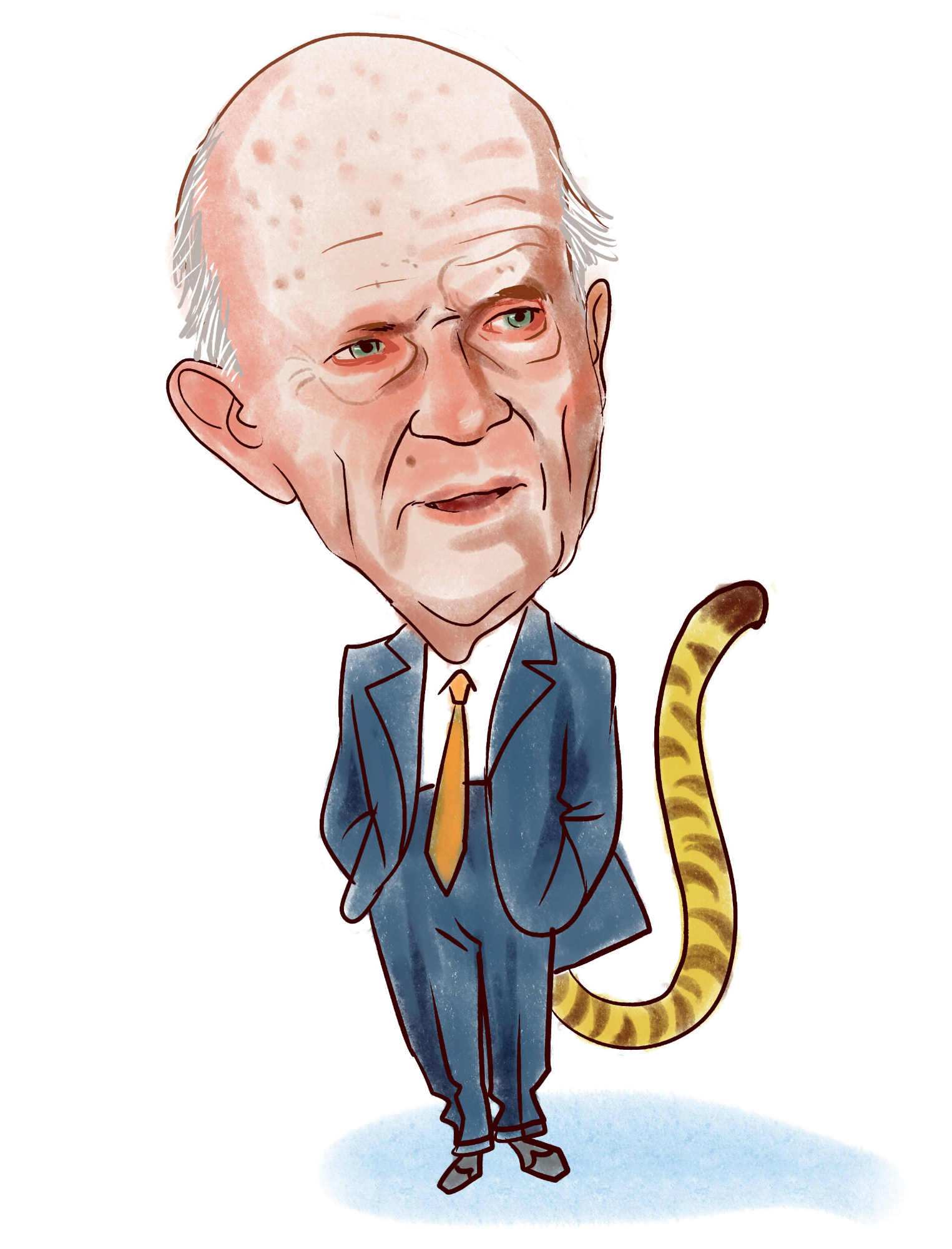

Well over a decade ago, the late, great, Julian Robertson gave an interview where he recalled being too early (i.e. wrong!) in shorting the Dot-Com Bubble in 1999/2000. Robertson had founded Tiger Management, one of the first hedge funds, in 1980, and is still considered to this day to be a Wall Street legend, mentoring tons of future stars.

In the interview, Robertson noted that if it were not for the treadmill and the support of his family, he might not have made it through such a stressful period where nothing seemed to make sense to him.

I am reminded of that interview in the current market, where wildly steep charts, expensive, narrow leadership, euphoric sentiment, and tons of splashing around in trash meme stocks all fly in the face of various serious headwinds.

As noted yesterday, tomorrow morning's CPI inflation print is set up for a classic sell-the-news moment, despite how that never seems to work anymore. Clearly, the consensus is already established that a cool print is guaranteed.

But what, then? We have already seen the likes of Microsoft, below, over $2 trillion in market cap at a 30 forward PE print a marginal new high this year. And it did so on a bearish RSI monthly divergence (bottom pane on monthly chart, below).

And don't blink now, but gasoline prices just hit their highest levels since April today, despite all the talk of deflation.