18Jul3:35 pmEST

The Sun Sets on Slam Dunk Investing

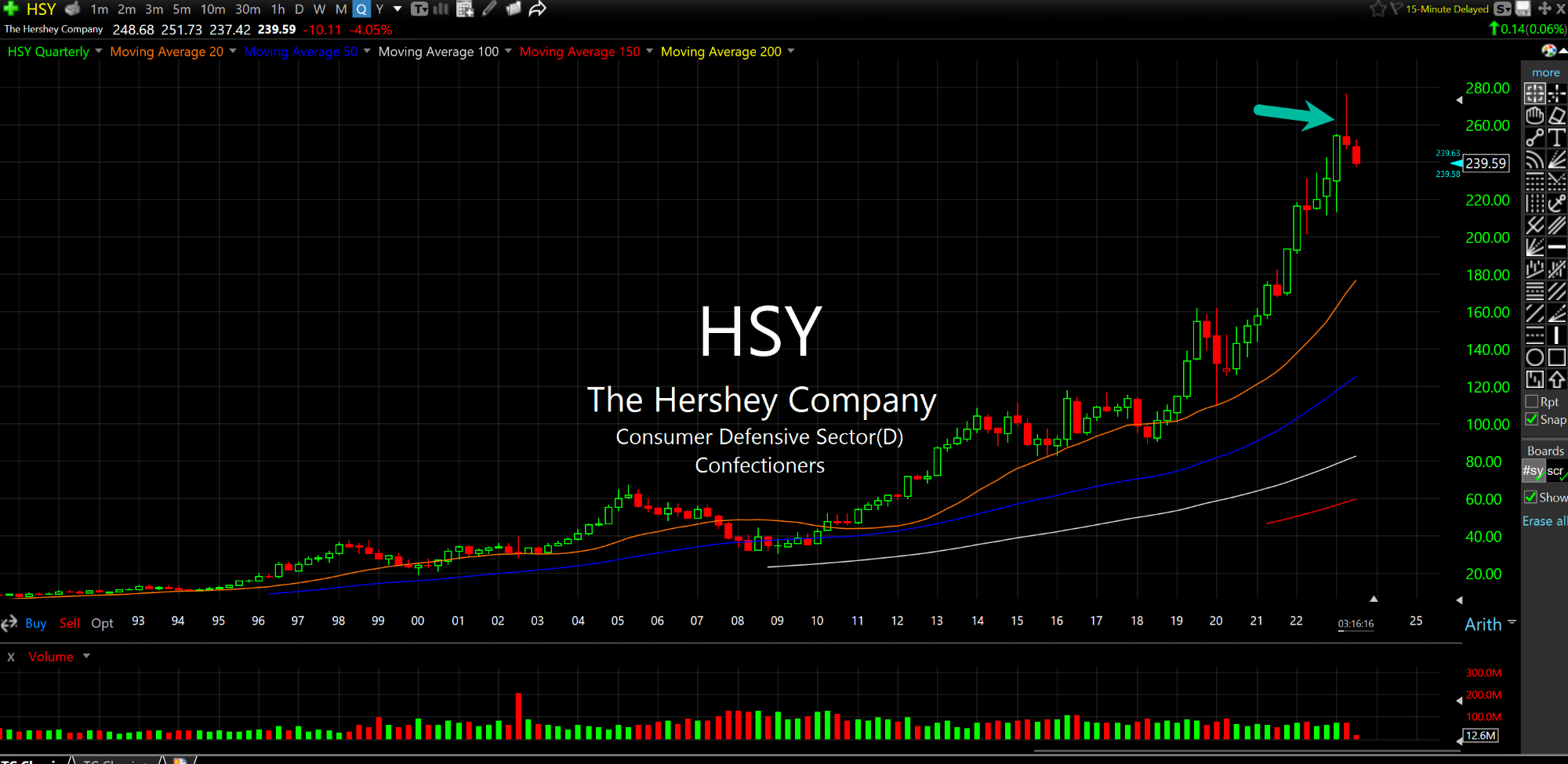

Earlier today I was reminded by a Member who had nailed the weakness in Hershey, below on the quarterly chart, that the iconic confectioner in central Pennsylvania had defied the market melt-up and has been as weak as any name since early-May.

Alongside KO MCD PEP, I would have to say HSY represents the QE/ZIRP liquidity bonanza insofar as them being defensive names which are now expensive in terms of valuation and very extended on long-term timeframes regarding their one-way uptrends for over a decade. Simply put, this is not grounds for long-term investing at these levels and at these valuations. While there are some deep values out there or emerging, the obvious defensive names are not among them.

And while the market remains smitten with the Nasdaq and many growth/tech names at-large, HSY confirming its Q2 shooting star quarterly bearish reversal candle (arrow, below) after that historically steep uptrend could easily be a sneak preview of what is to come for mega cap tech.

I recognize the bullish spin on this is that defensives are getting sold and growth is being gobbled up, bullish as can be.

But during times of inflation that is flat-out wrong: The defensives and divided payers will ultimately outperform..only after getting cheaper first.

The difference is that growth/tech will get cheaper, too. However, they will then not outperform as the entrenched inflation takes hold this decade.

In fact, they will lag and more than a handful of them will outright go out of business.

Don't Write Off This Civiliz... Seinfeld Economics; TINSTAAF...