11Dec3:03 pmEST

A Divergence, I Reckon

This will be a critical week for many markets, of course, headed into 2024 with the FOMC on Wednesday. The next FOMC after this one will not happen until the final day of January of next year.

In particular, gold and silver metals are getting hit again today, with silver down hard over the last six trading sessions after its prior steep rally with the entire precious sector.

That said, the precious metals miners look to be diverging bullishly from the metals. I have always thought that when the miners outperform the metals it can be an excellent "tell" of underlying risk appetite legging back into the complex.

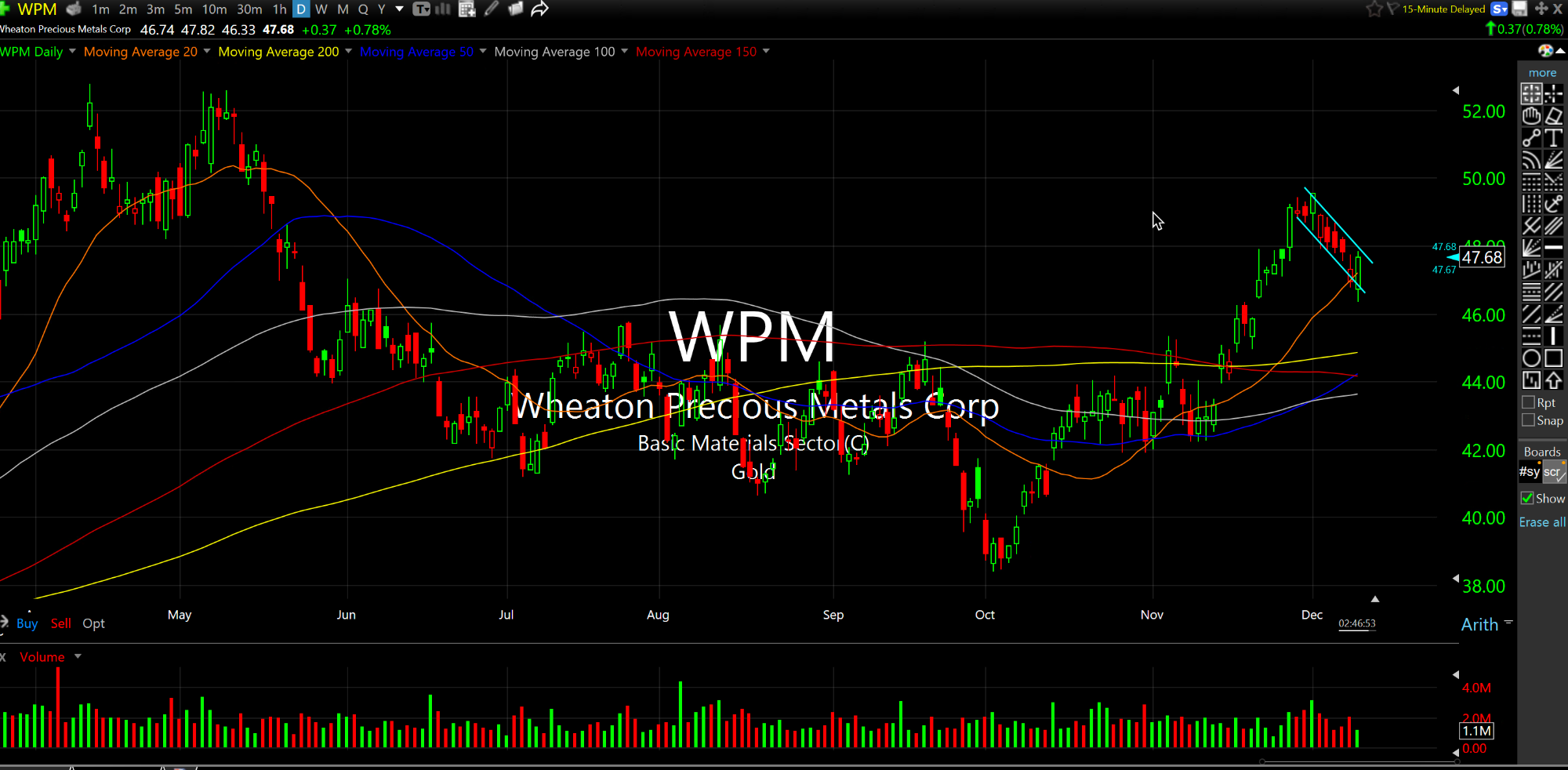

Here, a miner like Wheaton (WPM, below on the daily chart, a relatively larger cap miner) is tightly flagging and clearly positively diverging from the precious metals themselves today, too. Other miners fit the bill, too, as we note for Members.

Barring something which truly slams the precious complex on Wednesday, the slightly relief rally in the metals should see miners like WPM flourish as it is still a wholly intact bullish setup despite the silver ETF, SLV, trading below all daily chart moving averages today.

Weekend Overview and Analysi... All Roads Lead to Rome...And...