04Jan2:24 pmEST

Choose the Right Dip in 2024

One of my early observations about the tape this morning on the private Twitter feed for Members was that the market had the feel of coasting into tomorrow morning's jobs report.

In other words, after selling off for the first few days of 2024, after previously melting up to cap of 2023, a bit of a mixed, drifting session was likely in order before a scheduled, big macro event like the NFP tomorrow morning pre-market.

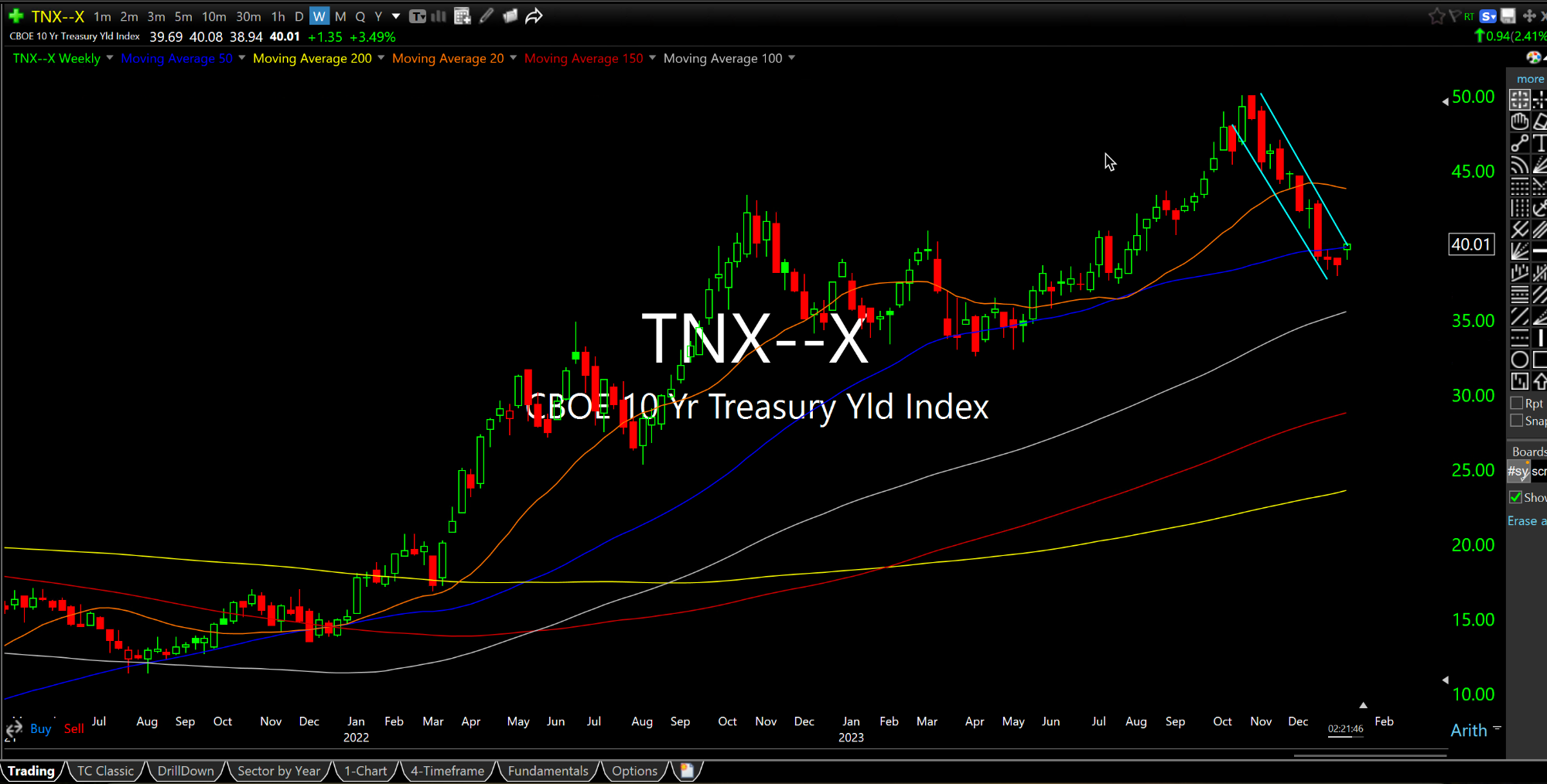

With this in mind, I see many folks preoccupied with buying the early-2024 dip in stocks. However, to my eye the dip in rates, seen below on the weekly chart for TNX (the Index for Rates on the 10-Year Note) is the buyable one. Rates are back over 4.0% as I write this, just as the side of the boat expecting multiple rate cuts and much lower rates this year became crowded into the holidays.

As for the dip in stocks, with Apple weak again I strongly suspect there are large players repositioning themselves for the possibility of rates staging a surprise resurgence higher, thus completely reversing the basis for the year in Q4 2023 regarding rate cuts and disinflation.

Also note the (extreme) dip in natural gas continuing to get bought, perhaps front-running a looming frigid winter stretch. Here, again, a surprise move higher in natty, like rates, could ruffle some feathers with the consumer and equities.