15Feb3:07 pmEST

Keeping it Actionable When the Action Goes Off the Rails

One would think rates would be knifing back under 4.2% today, given the continuing speculative mania in SMCI, for example, as the AI bubble rolls on. However, that is not the case: Rates are barely down.

Furthermore, Jeff Bezos is unloading billions of AMZN and now Warren Buffett is selling some of his AAPL (mind you, Buffett prefers to hold names indefinitely). We also have GOOGL a notable laggard today as news circulates of NVDA passing it in terms of market cap.

That said, as long as SMCI surges higher on a daily basis, and perhaps other AI plays too, bulls can keep laughing at how easy the market is for them despite inflation ticking back higher.

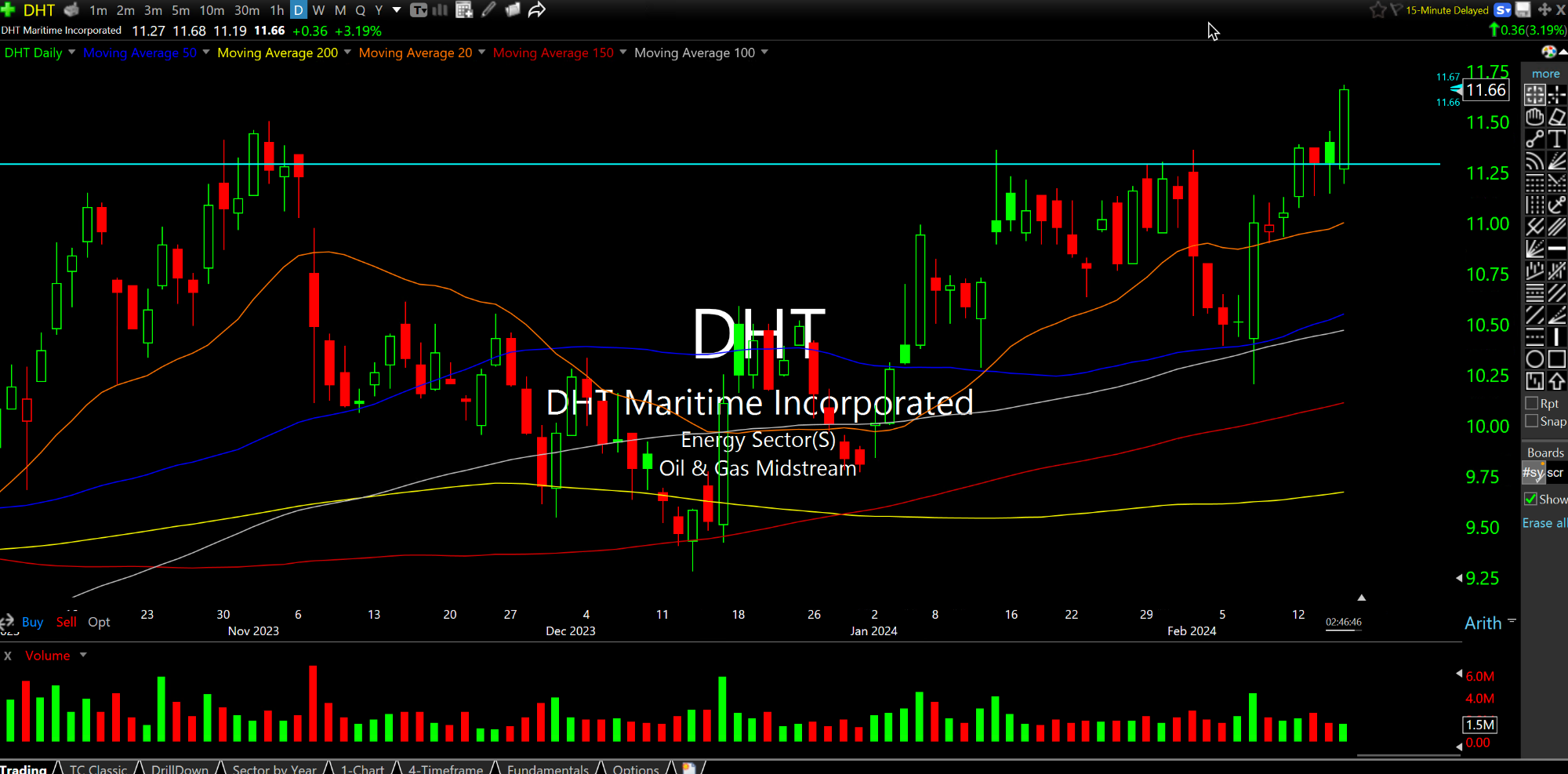

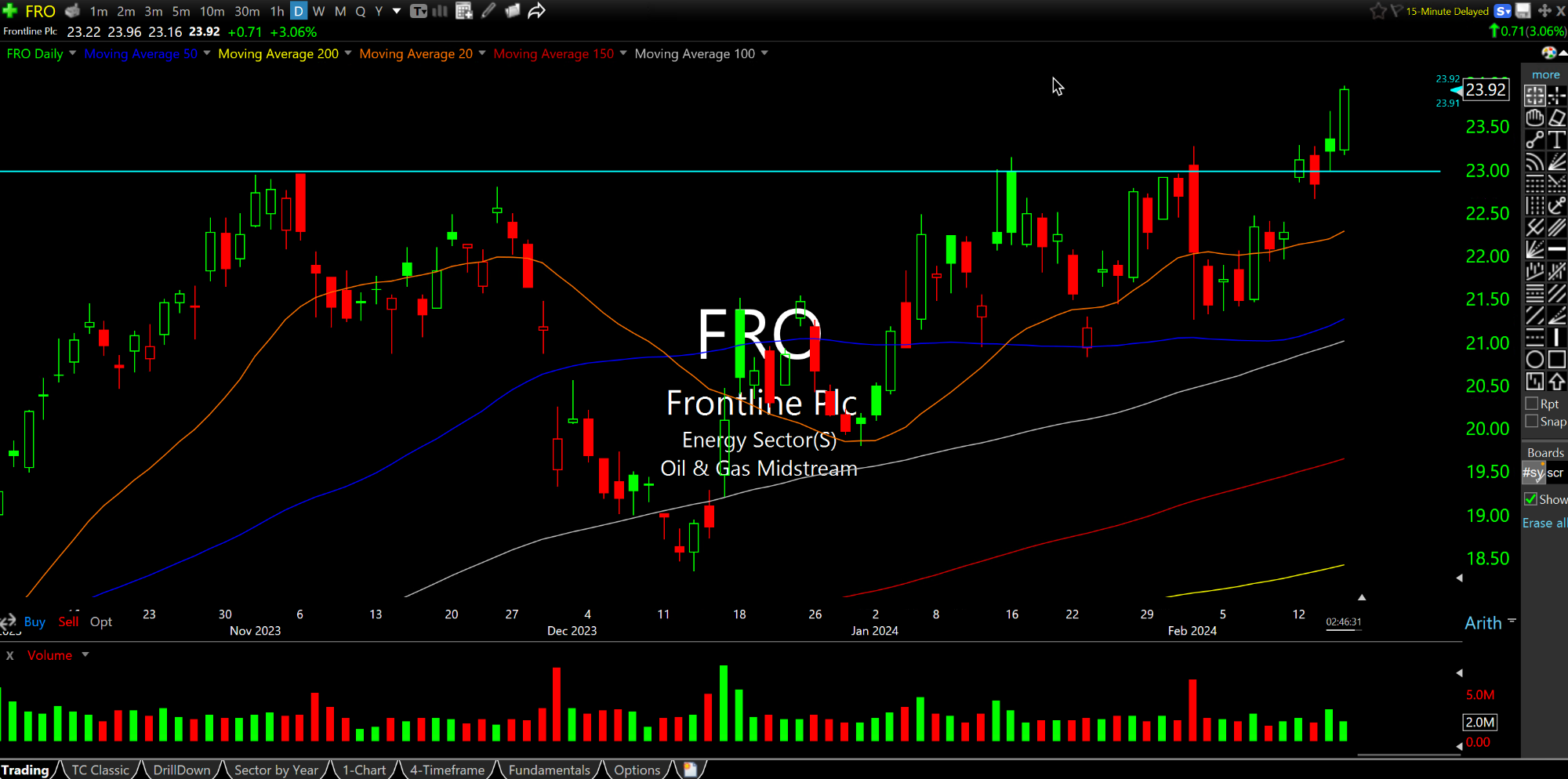

I will not be chasing up tech growth here, but I will keep things actionable: The oil tankers (and many oil stocks in general) are having a great day.

We have noted the likes of DHT FRO (first two daily charts, below, respectively) here and with Members for a while now as bullish setups.

Also note TNK in play to follow the gang higher.

Too Many Kisses on Valentine... Afternoon Update 02/16/24 {V...