11Mar12:26 pmEST

Very Well. I Accept Your Blackmail

It almost seems as though bulls are attempting to, in a way, blackmail this market.

The much ballyhooed extended leaders in the "Magnificent 7," alongside semiconductors at-large, have obviously been the focal point of the melt-up. Bulls argue that looming rate cuts this year amid a soft landing justifies all of it--and the AI revolution repricing of risk upside. But even if their beloved leaders correct or even top, no worries--Bulls will simply rotate down to the obvious laggards in the Russell 2000 small cap Index.

All of this amounts to a kind of, "heads I win, tails you lose," thesis.

However, my counterpoint is that this historically bifurcated market (not merely winners versus losers, but extreme concentrations of capital at the very top of the market relative to history) does not sustain rotation. No, rotation is reserved for healthy bull markets. But, almost by definition, a bifurcated market is one where the market loses its discipline, chasing the movers and leaving the losers to such an historical extreme that it yields the likes of NVDA pricing in perfection for years to come.

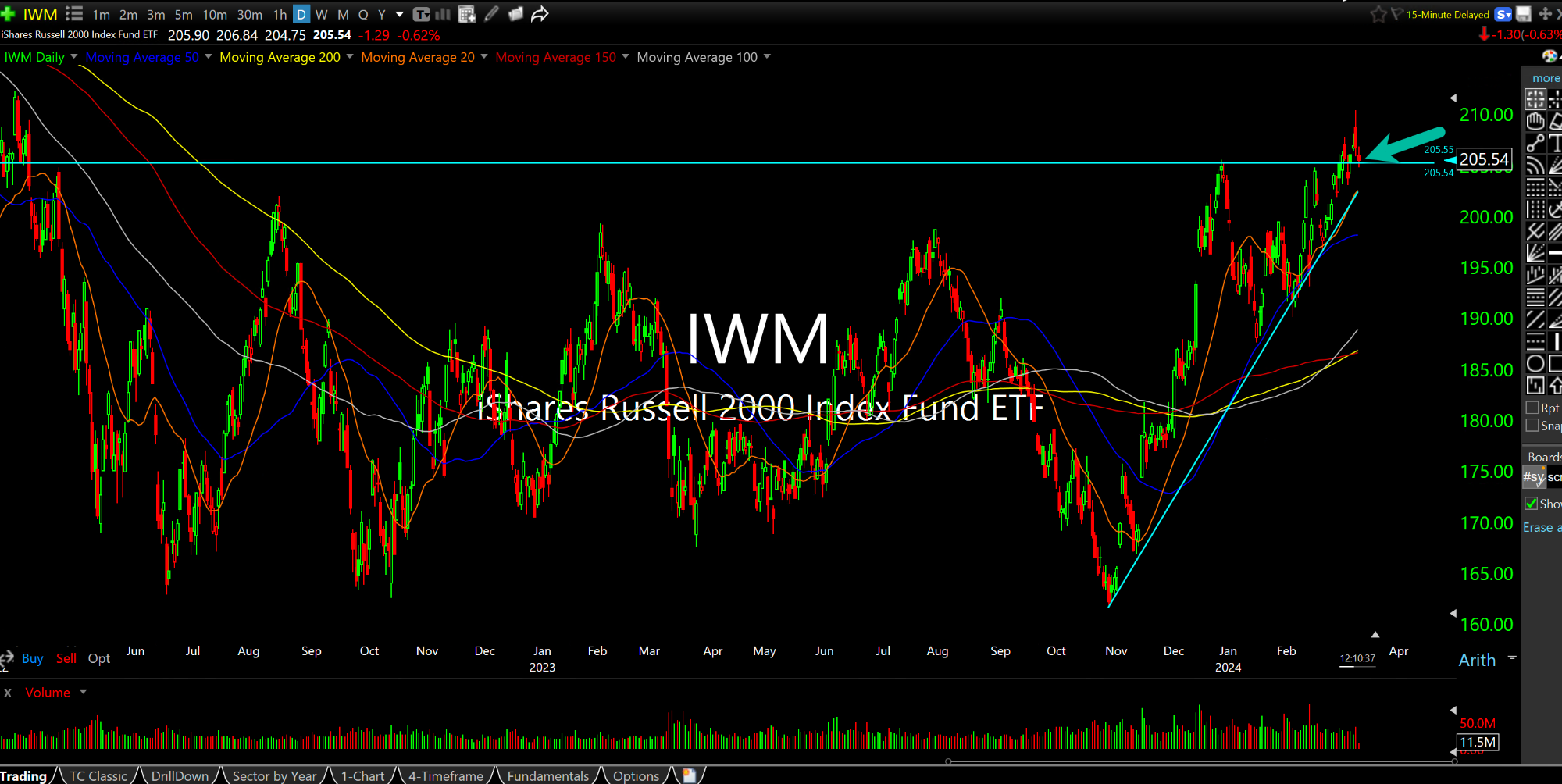

On that note, on the IWM daily chart, below, for the small caps in the Russell, my view is that this $205 breakout will fail and spawn an ugly bull trap in the coming weeks and months. I expect follow-through below $200 in short order to confirm the trap and lack of healthy rotation.

Very well, bulls. I accept your blackmail.