28Mar11:06 amEST

Silver is Risen

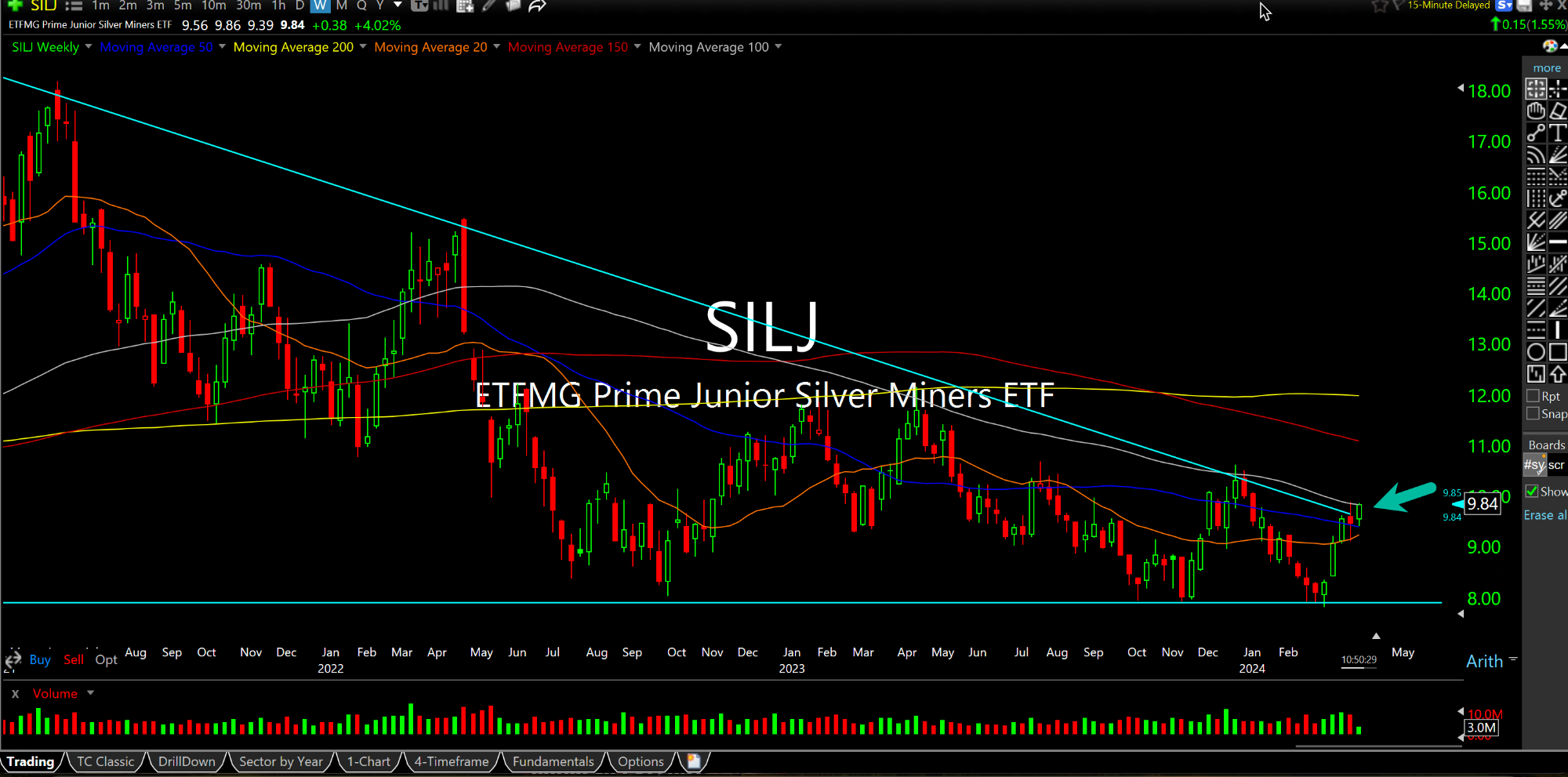

Quietly a strong end to the holiday week for gold, silver, and their miners.

Granted, tomorrow's PCE report with the cash markets closed will be a major event, especially once Easter dinner is done and Sunday night futures open into the new month and quarter on Monday.

However, recall during the 1970s that gold and metals/miners performed the best of almost any asset class primarily when The Fed was deemed to be totally wrong on inflation--Those times in the 1970s where The Fed either did cut or wanted to cut but instead, later on, had to do an about-face with rising inflation and hike. During those times, gold was a nasty "check" on The Fed's mistakes.

Here, despite the jubilation in equities for five months now, including a laughably steep melt-up on the indices, the pertinent issue is if inflation keeps on rising and folks cannot keep making excuses for it with a straight face. I doubt they are already, but the vast array of excuses for the recently hot CPI prints certainly seems to have run its course.

A hot PCE tomorrow should see metals and miners spike into next week, with the silver junior miners, again below on the weekly chart, peeking their collective head out for a major breakout.

AT&T Set to Outperform NVIDI... Weekend Overview and Analysi...