28Apr12:20 pmEST

The Clock is Ticking

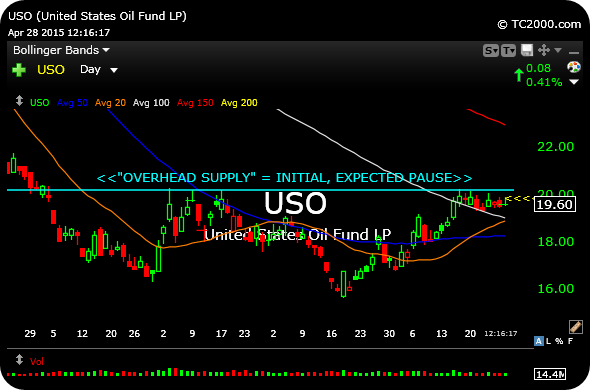

Working our way into the east coast lunch hour, note that crude oil, keying off the USO ETF, is not showing much urgency to rally over its $20.20 upside breakout level even as the U.S. Dollar continues to weaken, amid other headlines. The clock sure does seem to be ticking at this point for crude bulls to sustain another leg higher. Failure below $19.10 now on the USO could easily see a sharp shakeout, even if no new lows come.

My working thesis for many months now has been that crude would simply settle into a long slog sideways, frustrating bottom and crash-callers alike. With the action today, even with select energy and materials equities benefitting from rotation, that seems to be the case.

Elsewhere, note my morning post about AAPL, as it figures to be all about the close and afternoon action. The stock has reversed to green and is whipping around as we speak, and so is the market at-large for the matter.