22May1:28 pmEST

It's a Free Country, Brother

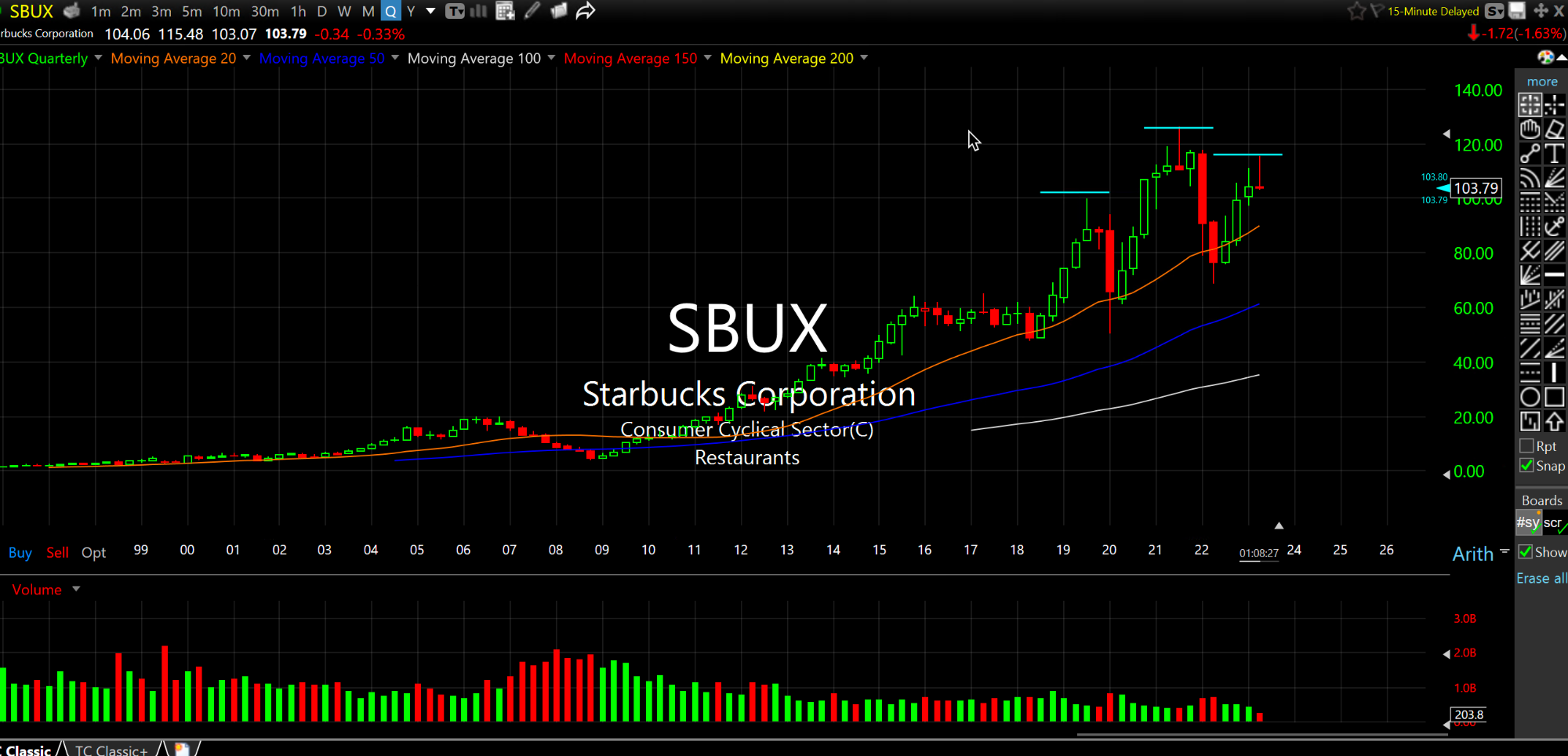

Last year I penned a blog post where I wrote that Starbucks had substantial downside. Clearly, that was wrong as the rally in 2023 as SBUX opened the year at $100.56 and went as high as $115.48 on May 1st.

However, viewing the updated quarterly chart, below, as the great liquidity drain from markets has seen various long-term charts extend up and form what I view to be even more massive multi-year tops, SBUX remains uniquely vulnerable to my eye on multiple timeframes.

On shorter-term timeframes, the chart is weakening amid a flurry of bearish news of late.

But the quarterly chart indicates a "high" right shoulder (yes, the right shoulder can and often is higher than the left in valid head and shoulders bearish tops) as the recent rally fades and SBUX is a glaring laggard today.

I tend to take quite a bit of heat each time I come out with a bearish SBUX post, as the name has endeared a ton of steadfast bulls over the years. I can take the heat, though, and often feel it around the corner.

In some ways, SBUX was one of the very best beneficiaries of ZIRP/QE and then the stimmies with easy money, since most folks could afford to walk into a Starbucks daily and spend the extra money on a 1,000 calorie milkshake for breakfast or something akin to that.

But with higher rates I still think the risk of normalization with consumer behavior is too menacing not to look at SBUX, with its expensive valuation, on the short side going forward.