05Mar12:29 pmEST

Bring on the Passive Aggressive Types

The main reason why textbook bearish head and shoulders topping patterns tend to work so well at ushering in new bear markets and are quite obvious (in hindsight!) is, ironically, that they have failed numerous times on the way up during the bull run. And in this liquidity-driven bonanza since 2009 and especially since the pandemic that likely counts double, as bulls have become quite adept as making passive-aggressive comments blasting any sort of bearish technical analysis.

But unless this time truly is different in world history, the tide eventually turns.

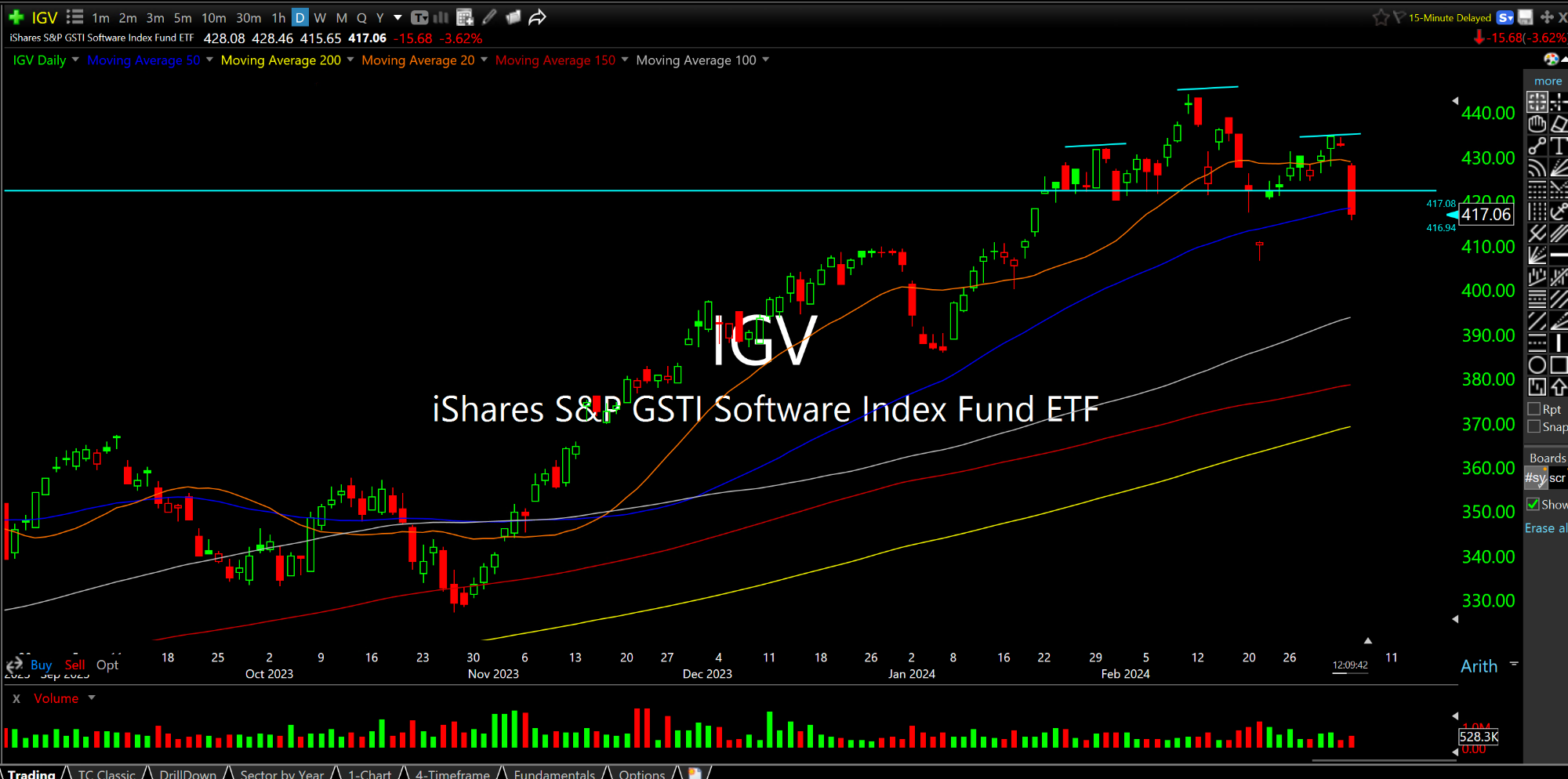

And with software among the leaders lower in today's session, the IGV sector ETF (daily chart, below) is sporting a head and shoulders top which looks to be confirming, pending today's close below $420. Individual names like MSTR ZS SMAR are getting blasted, among many others.

Headed into Powell's testimony before Congress the next two days it will be yet another test of the bubble euphoria to see if bulls can shake off what will likely be the Fed Chair tempering any expectations for imminent rate cuts.

For now, software is unwinding and I am not in the camp that a garden variety healthy pullback is in the cards--After all, the ascent was not particularly controlled or healthy, so history suggests the unwind will be even more violent.