06Mar11:19 amEST

A Profile in Cowardice

It is fascinating to see that, despite the plethora of seemingly hawkish comments by Chair Powell this morning in front of Congress, Bloomberg ran a YouTube clip soundbite with the title, "Fed Chair Powell: Likely Appropriate to Cut Rates This Year."

Even though Powell's "likely appropriate" comment on rate cuts came before and after a chunk of tough-talk, once again all the market cares about is the Fed Chair dangling the prized rate cuts as a distinct possibility in the near-future.

At this point, it is downright comical that Powell cannot deliver a fully hawkish speech or bout of comments without couching it with a dovish comment which then, in turn, sparks another risk-on rally, easing financial conditions and driving up inflation, thereby undermining any hawkish comments he made in the first place.

On that note, you may have noticed the gold metal having an outstanding last week or so, with futures printing new highs. As I discussed with VIP Members in last month's long-term investing update, I continue to stock up on physical gold myself, favoring Bank of China panda gold coins with .999 purity from the 1980s, for a variety of reasons.

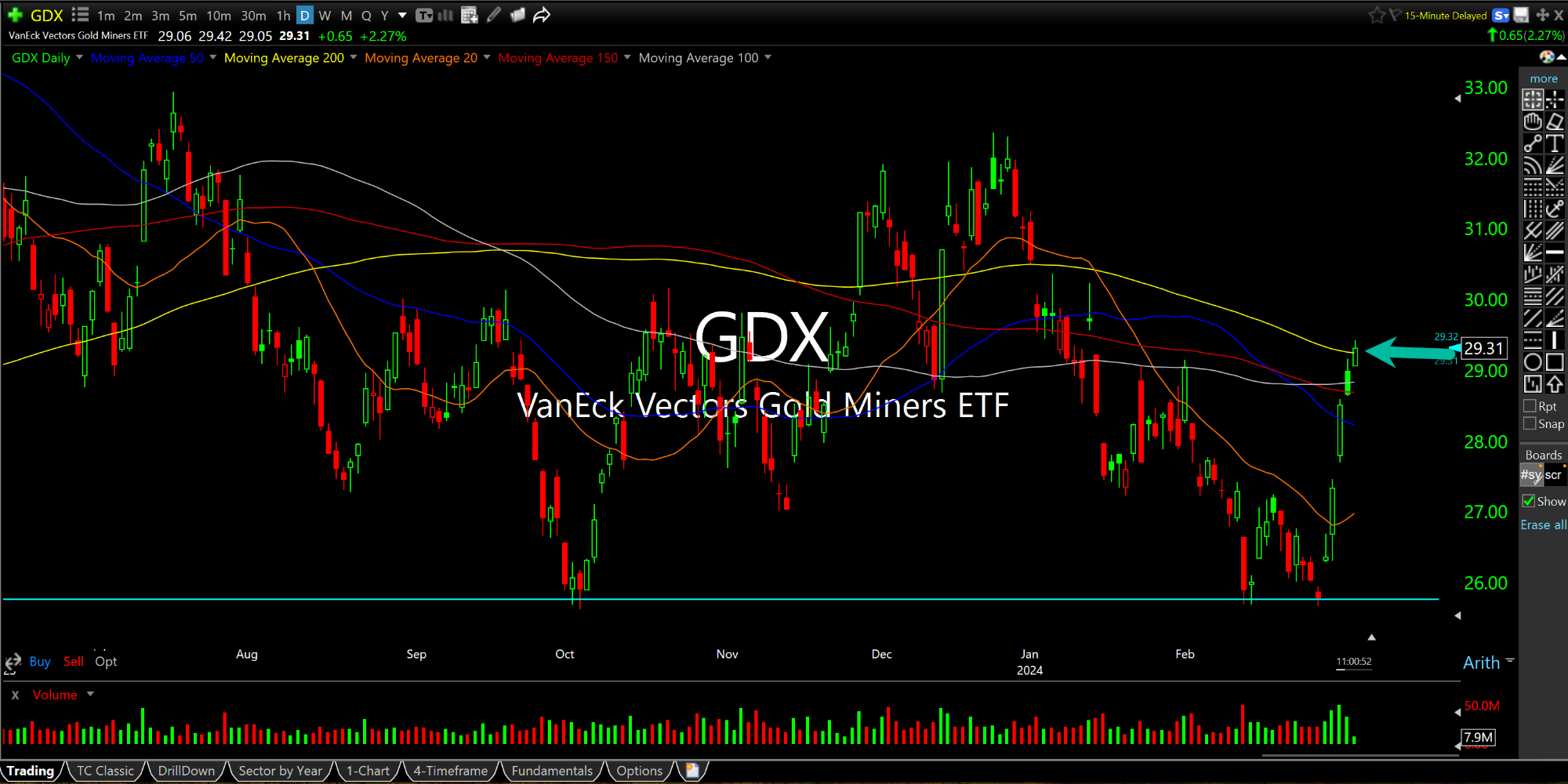

As for the miners, the GDX ETF is back up to its 200-day moving average. Clearly, the miners have not been as impressive as the gold metal itself. So I want to see the GDX not be swiftly rejected here, and instead flag out for a few days to set up a quality long entry.

Also note dips in natural gas continue to get bought, for a few weeks running now and to little fanfare, especially as most eyes are on crude oil moving higher today.

There are always, and I mean always, consequences in economics. While it seems like the Treasury and Fed (and Congress and White House...) can get away with as much reckless easy policies as they want, commodities might finally be trying to send a signal that enough is enough, in an election year no less.

Bring on the Passive Aggress... Reminiscent of a Certain Tim...