02Dec3:33 pmEST

Still in Time-Out Mode in the Corner

Although I sold the rest of my bearish energy sector ETF yesterday morning to lock in that win, I did not flip long for the bounce.

Instead, I still view bounces in the energy stocks as suspect and prone to rolling back over. The reasoning is two-fold. First, there has been meaningful, high sell volume technical damage sustained. Beyond that, many traders seem eager to bottom-fish the space for reversion rallies or major bottoms.

Thus, another leg down or at least retest of recent lows seems likely in the coming weeks. I have ERY back on my radar to play any such developments from the bear angle.

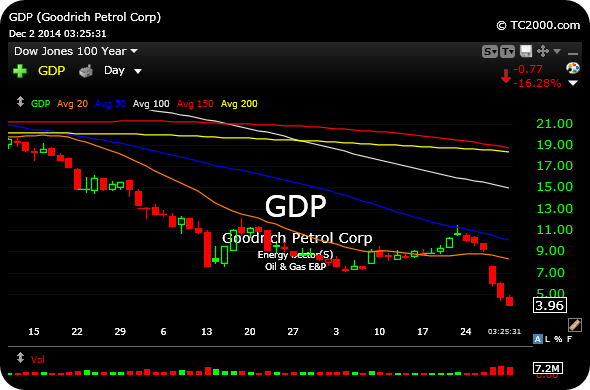

Also note that even with the XLE bouncing back, select names like GDP are still in time-out mode, with liquidation (forced selling likely by trapped hedge funds needing to sell, rather than wanting to) quite obvious on the daily chart, below. Put another way, the sector is still trading ominously and caution is advised even for quick bounce trades.

Although I sold the rest of my bearish energy sector ETF yesterday morning to lock in that win, I did not flip long for the bounce.

Instead, I still view bounces in the energy stocks as suspect and prone to rolling back over. The reasoning is two-fold. First, there has been meaningful, high sell volume technical damage sustained. Beyond that, many traders seem eager to bottom-fish the space for reversion rallies or major bottoms.

Thus, another leg down or at least retest of recent lows seems likely in the coming weeks. I have ERY back on my radar to play any such developments from the bear angle.

Also note that even with the XLE bouncing back, select names like GDP are still in time-out mode, with liquidation (forced selling likely by trapped hedge funds needing to sell, rather than wanting to) quite obvious on the daily chart, below. Put another way, the sector is still trading ominously and caution is advised even for quick bounce trades.

Twitter Opting for the Red B... Stock Market Recap 12/02/14 ...