09Dec12:22 pmEST

Tipping Over Versus Ready to Surge Again

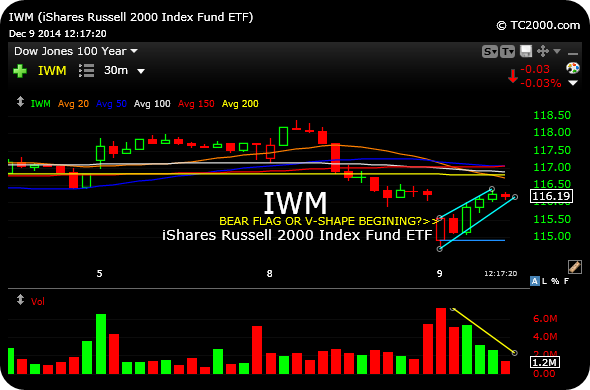

The small cap ETF for the Russell 2000 Index, seen below on the 30-minute timeframe, presents a familiar setup we have seen during this bull market--An abrupt sell-off at the open, followed by an exuberant bounce. Generally speaking, even if bull markets we could then see a rollover to retest or magically make new lows (before buyers come in with more conviction).

However, this particular bull run has seen more than our fair share of V-shaped rallies to fresh highs.

So, as we see another potential bear flag forming on that 30-minute chart, it is worth paying even closer attention to the outcome for any signs of more meaningful changes in character as far as the broad market goes.

If we do see IWM lose $116 lower, I have eyes on TZA this afternoon to play the short side, as that is a triple-short bearish ETF for the Russell. Otherwise, I suspect we may grind into the bell without much more information to takeaway.

As for the metals and miners, I am watching their intraday consolidations closely, too, to see if I should add or close out my DGP NUGT longs from yesterday.

The small cap ETF for the Russell 2000 Index, seen below on the 30-minute timeframe, presents a familiar setup we have seen during this bull market--An abrupt sell-off at the open, followed by an exuberant bounce. Generally speaking, even if bull markets we could then see a rollover to retest or magically make new lows (before buyers come in with more conviction).

However, this particular bull run has seen more than our fair share of V-shaped rallies to fresh highs.

So, as we see another potential bear flag forming on that 30-minute chart, it is worth paying even closer attention to the outcome for any signs of more meaningful changes in character as far as the broad market goes.

If we do see IWM lose $116 lower, I have eyes on TZA this afternoon to play the short side, as that is a triple-short bearish ETF for the Russell. Otherwise, I suspect we may grind into the bell without much more information to takeaway.

As for the metals and miners, I am watching their intraday consolidations closely, too, to see if I should add or close out my DGP NUGT longs from yesterday.