06Jan11:38 amEST

In the Company of Adult Trading

Any levered ETF is effectively trading in "adult swim" territory, long or short, equities or commodities, due to the high beta and gapping nature of the instruments.

Thus, "buy and hold" philosophies for them can be deemed a disaster waiting to happen, due to the decaying nature of many of them, on top of the price swings and volatility.

Hence, when I have immediate gains in a levered instrument like NUGT (3x long gold miner ETF derived from GDX), I am inclined to scale part of the win and trail up a stop-loss.

In addiiton, I also key off the straight-up ETF when trading the leveraged products for technical analysis.

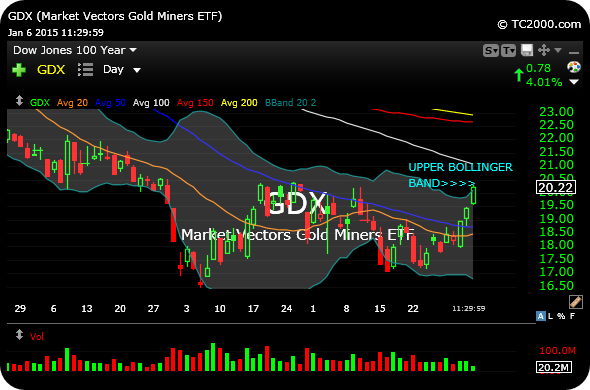

As an example, I keyed off GDX, the straight-up senior gold miner ETF, when trading the levered NUGT, to stay objective.

Note GDX now at its upper daily chart Bollinger Band today, rendering it short-term overbought. If this is a bear market bottom for miners, however, then we should actually see the miners remain stubbornly overbought for a good while, ignoring the upper Band.

Still, that would be jumping the gun on my part to assume a bear market bottom. And thus I "scaled and trailed" NUGT. As I noted, I am looking to add back to the position if the action continues to impress.

Any levered ETF is effectively trading in "adult swim" territory, long or short, equities or commodities, due to the high beta and gapping nature of the instruments.

Thus, "buy and hold" philosophies for them can be deemed a disaster waiting to happen, due to the decaying nature of many of them, on top of the price swings and volatility.

Hence, when I have immediate gains in a levered instrument like NUGT (3x long gold miner ETF derived from GDX), I am inclined to scale part of the win and trail up a stop-loss.

In addiiton, I also key off the straight-up ETF when trading the leveraged products for technical analysis.

As an example, I keyed off GDX, the straight-up senior gold miner ETF, when trading the levered NUGT, to stay objective.

Note GDX now at its upper daily chart Bollinger Band today, rendering it short-term overbought. If this is a bear market bottom for miners, however, then we should actually see the miners remain stubbornly overbought for a good while, ignoring the upper Band.

Still, that would be jumping the gun on my part to assume a bear market bottom. And thus I "scaled and trailed" NUGT. As I noted, I am looking to add back to the position if the action continues to impress.