26Jan10:25 amEST

Reading the Morning Tape

The market fought back from its losses in the futures last night. But, as I write this, we are in the red as far as the major indices are concerned. However, beyond my SDS long (meaning I am long the ultra-short S&P 500 Index ETF), it remains a tough environment for macro bears unless and until biotechnology stocks give up the ghost.

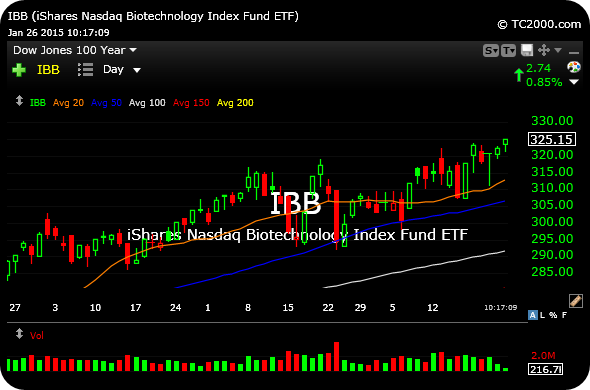

On the first daily chart, below note the IBB ETF for the biotechs soundly in the green. A melt-up, or "blow-off top" is still a risk to shorts.

It is not all roses, though, as financials could still be setting up for shorts. Note MS on the second chart, below, showing a daily timeframe bear flag which many other big banks do, as well. Of course, we know the carnage in names like OCN, too.

In addition, the precious metals miners are back to first logical levels of support where I would consider a buy. I am looking to see if GDXJ holds its 20-day simple moving average, around the $27 area.

The market fought back from its losses in the futures last night. But, as I write this, we are in the red as far as the major indices are concerned. However, beyond my SDS long (meaning I am long the ultra-short S&P 500 Index ETF), it remains a tough environment for macro bears unless and until biotechnology stocks give up the ghost.

On the first daily chart, below note the IBB ETF for the biotechs soundly in the green. A melt-up, or "blow-off top" is still a risk to shorts.

It is not all roses, though, as financials could still be setting up for shorts. Note MS on the second chart, below, showing a daily timeframe bear flag which many other big banks do, as well. Of course, we know the carnage in names like OCN, too.

In addition, the precious metals miners are back to first logical levels of support where I would consider a buy. I am looking to see if GDXJ holds its 20-day simple moving average, around the $27 area.

Weekend Video Strategy Sessi... A Good Place to Look for Pyr...