03Feb12:17 pmEST

Signs of the Bread Basket Storm Passing

While crude oil is getting much play for its snapback rally from badly beaten-down conditions, soft commodities are also staging relief rallies today.

Just like oil, the softs have been pummeled in recent months, which I am sure has been just one consequence of the U.S. Dollar runaway freight train higher.

Nonetheless, the greenback is coming in this week. And softs are bouncing hard today. Corn, sugar, soybeans, and wheat are just some of the softs acting well.

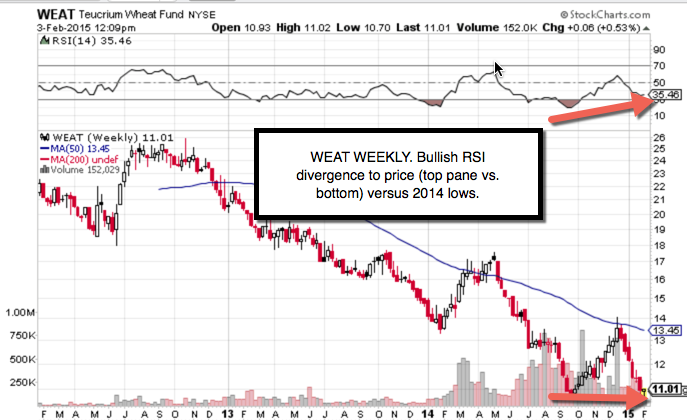

To put the swoon in softs of late into perspective, though, you can see the weekly chart for the WEAT fund, below, flashing a clear bullish RSI divergence to price relative to the prior lows back in October 2014. What this means is that sellers are losing downside momentum on this thrust lower compared to the last time price was down here, thus creating the bullish divergence.

This bullish divergence is not sufficient evidence to call a major bottom to softs. But it does provide the context for a quick trade, especially if the Dollar continues to come in. A few tickers which equity-driven traders may want to keep on the radar: CORN DBA JO SGG WEAT.

While crude oil is getting much play for its snapback rally from badly beaten-down conditions, soft commodities are also staging relief rallies today.

Just like oil, the softs have been pummeled in recent months, which I am sure has been just one consequence of the U.S. Dollar runaway freight train higher.

Nonetheless, the greenback is coming in this week. And softs are bouncing hard today. Corn, sugar, soybeans, and wheat are just some of the softs acting well.

To put the swoon in softs of late into perspective, though, you can see the weekly chart for the WEAT fund, below, flashing a clear bullish RSI divergence to price relative to the prior lows back in October 2014. What this means is that sellers are losing downside momentum on this thrust lower compared to the last time price was down here, thus creating the bullish divergence.

This bullish divergence is not sufficient evidence to call a major bottom to softs. But it does provide the context for a quick trade, especially if the Dollar continues to come in. A few tickers which equity-driven traders may want to keep on the radar: CORN DBA JO SGG WEAT.

More Spreads Than Your Super... Cutting a Loser and Locking ...