13Mar11:53 amEST

Jumping to the Other Side

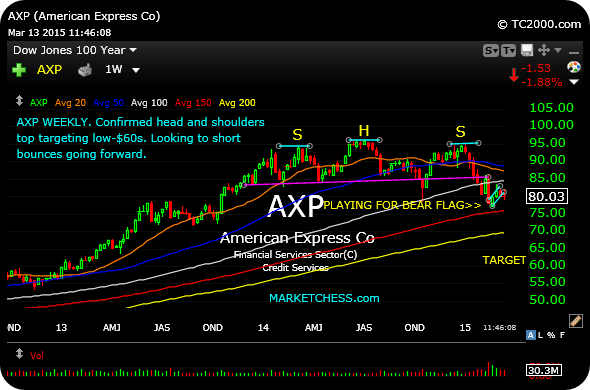

Below I present the AmEx weekly chart, a name I went short earlier this morning.

Note the major confirmed top, targeting the low-$60's. I do not believe the recent bounce qualifies as evidence of a false breakdown, or bear trap. Instead, the most basic interpretation of the chart is the AmEx is jumping from bull to bear after multi-year run, with risk of the current bounce amounting to a bear flag, or bearish continuation pattern simply setting up the next leg down.

Elsewhere, Pandora continues to be a rumor-driven stock, discussed on my video last night as being capable of bouncing.

The runaway U.S. Dollar appears to be pressuring commodities again, namely crude.

And I may very well hop back into a CAT short with the risk of a major breakdown, dating back a decade, yet again.

This Trade is a Contender No... Pier to Somewhere or Nowhere...