20Mar2:05 pmEST

Making Sense of the Battles

Along with equities rising and stealing the headlines, commodities look to be turning in a solid week overall, namely gold and especially silver.

Even copper, however, participated in the post-FOMC rally, along with some softs such as corn, coffee, and wheat.

At issue is whether any type of commodity trade has legs in the coming weeks, or instead is merely a one-off pop in the wake of an apparently dovish Fed.

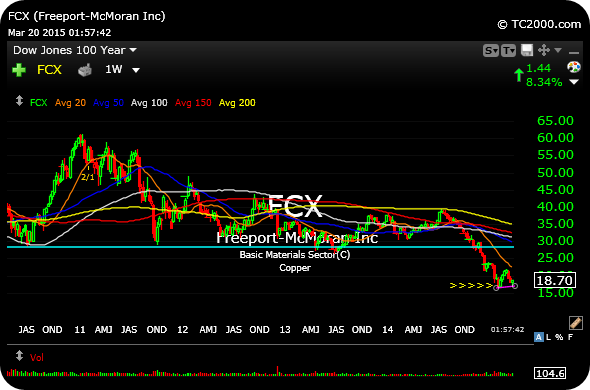

For answers, I am keying off FCX in some way, seen below on the weekly timeframe. You are talking about a mining firm with not only copper but also gold exposure, too.

We already looked at the major, multi-year breakdown that Freeport staged along with copper late-last year. But Freeport is not quite back to its 2008 crash lows. That doomsday scenario still might occur.

However, look at the current setup I have highlighted a potential double-bottom, giving bulls a viable setup for at least a counter-trend, tradable rally.

And if that occurs, I expect the miners, metals, and most commodities to perform reasonably well. Of course, those who expect the U.S. Dollar rally to continue will disagree. But the setup is certainly there for some type of reversion trade.

Stock Market Recap 03/04/15 ... Delta Skidding Off the Toppi...