26Mar11:45 amEST

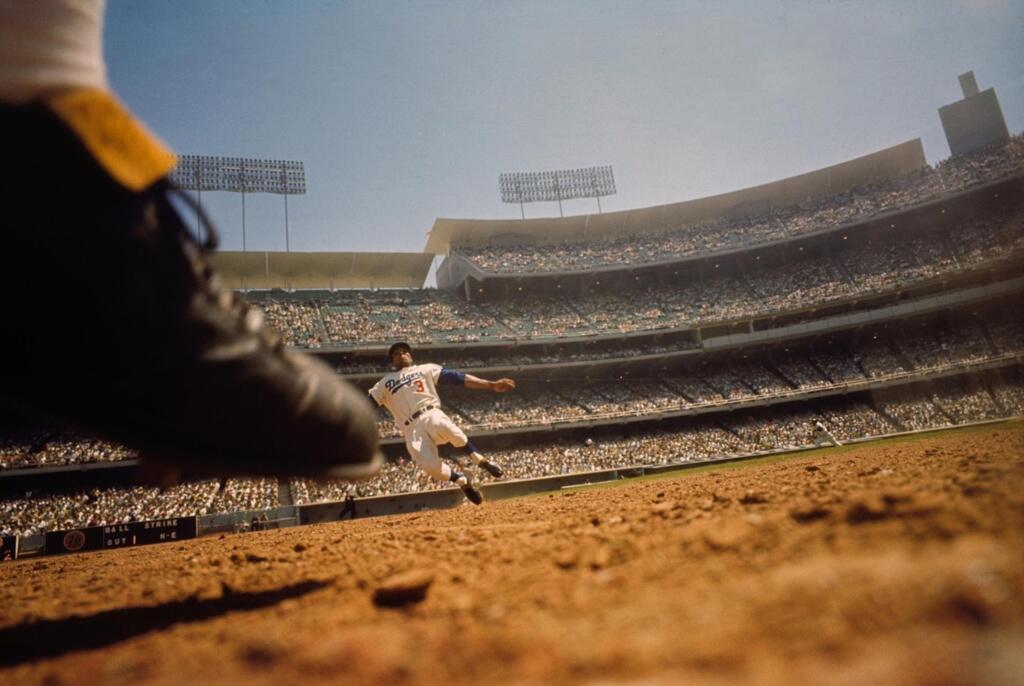

Sliding Into an Obvious Base

Both the QQQ and SPY, ETFs for the Nasdaq and S&P 500 indices, respectively, are sliding back down to their lows from mid-March.

On their 30-minute charts, zoomed-out below, I would not be surprised to see an intraday bounce off these levels, given that we slid down here in a fairly straight line, which may be happening as we speak.

However, I suspect a clean bottom off those prior lows is a bit too obvious and too many traders were looking to buy weakness this morning for it to hold. So I am not interested in playing that long side yet.

In terms of new trades, I am still noting the underperformance of the energy stocks in the XLE ETF versus crude oil in the USO. But do not have enough evidence to short the XLE, just yet.

And BBRY is breaking down from multi-month support, once again driving home a point we discussed several weeks ago that the stock is best viewed as a very short-term trading vehicle instead of a swing long candidate.