08Apr1:33 pmEST

A Beautiful Flag Up Top

Despite the U.S. Dollar and crude oil rising in unison yesterday, I am still not quite prepared to fully believe that the inverse correlation between the two has reached its conclusion.

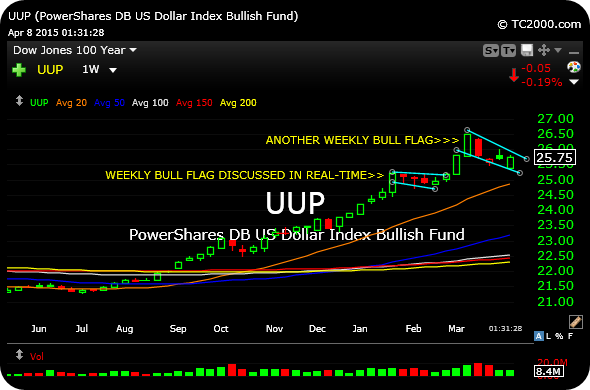

In addition, commodities as a whole remain suspect to me for anything more than quick swing scalp attempts, be it my win in NUGT or loss in UGAZ, as recent examples. In addition to most commodities themselves remaining in overarching downtrends, yet to cement major bottoms. the U.S. Dollar could easily be near completion of yet another textbook, beautiful weekly chart "bull flag" consolidation pattern.

Keying off the U.S. Dollar ETF, below, on the weekly timeframe, you can see as much.

Back in late-February, we discussed that the bull flag usually means an orderly consolidation within a uptrend, with the presumption of the bull run continuing higher in light of the lack of heavy sellers and the continues presence of buyers calm under pressure.

However, the main caveat is that the higher up you go without a sharp correction the more suspect each subsequent breakout becomes to being a short-term false breakout, or bull trap--Think of it as being a rubber band stretched too far out.

In this case, the Dollar may indeed be stretched, but momentum overall clearly remains on the side of the bulls since last summer.

With the FOMC Minutes coming up within an hour or so, I expect us to gain insight as to whether the Dollar is about to cement another tight bull flag higher, or instead will come in and perhaps give commodities some room to breathe. Until that resolves, I am not so quick to embrace the full-on rotation thesis this quarter.