05May10:11 amEST

Making a Statement with the Dollar

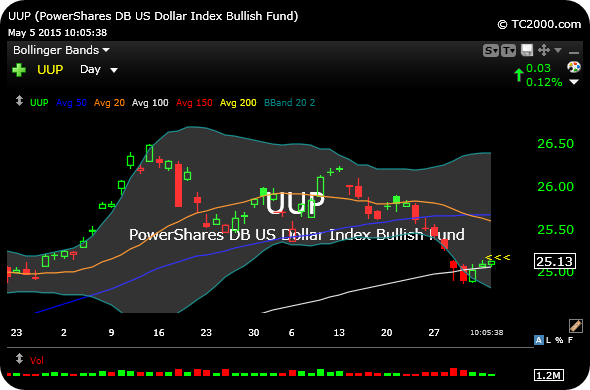

Even with the U.S. Dollar ETF, seen below on the daily timeframe for UUP, trying to stabilize at its 100-day moving average and green this morning, select commodities are flexing, namely crude oil.

In addiiton, natural gas has been on a tear of late and may finally be turning the corner into summer.

Precious metals remain rather sloppy overall, but have hung in well despite the Dollar's attempts to snapback this week.

However, most soft commodities have been taking it on the chin, save cotton of late.

Regarding crude, if the USO ETF can sustain a close over the $20.55 area I suspect another leg higher off the March lows could be in store, potentially up that ETF's 200-day moving average.

Either way, I continue to watch the interplay between the Dollar and commodities.

Stock Market Recap 05/04/15 ... Play it Safe with Baba Booey...