05Jun3:02 pmEST

Update on Crude Oil

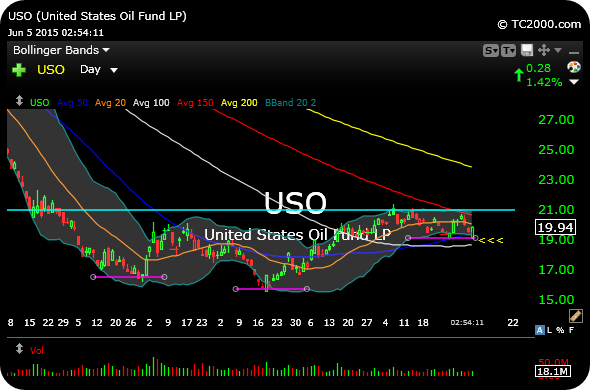

Keying off the USO ETF as a proxy for crude oil, note the daily chart, below, sporting a sharp upside reversal this afternoon right where bulls needed it.

Specifically, that $19 area represents a potential "right shoulder" of a massive inverse head and shoulders bottoming formation dating back to the swoon in crude at the end of 2014.

For a while now, I have largely been looking for a whole lot of nothing in crude, expecting a sloppy sideways range. But out of the rubble may come a bottom, or at least that is a scenario worth keeping on the radar.

As of now, crude bears would likely be best served by covering up into the weekend and reassessing a bounce next week. Similar comments apply to the energy stocks in the XLE ETF.

Not Such an Easy Company of ... Stock Market Recap 06/05/15 ...