12Jun2:46 pmEST

The Essence of a Choppy Market

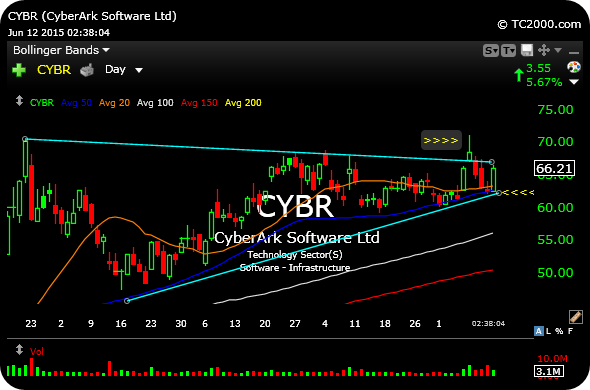

The daily chart, below, of HACK cybersecurity play, CYBR, is a good example of the type of action to expect in this sideways, choppy market until we see directional resolution.

Earlier this morning for members, we looked at initial signs of the stock finding support at the lower light blue support trendline. This came after the stock looked poised on Monday for an imminent, explosive breakout higher. Instead, a dramatic fade set in to take the stock back into the highlighted range.

In essence, this type of price action is to be expected in a rangebound market. Members were able to swoop in for a quick long trade this morning. But the true test will be sustaining follow-through higher next week, especially with the FOMC hoopla in play.

Elsewhere, note natural gas (UNG) gap-filling below today, another reason why selling out of UGAZ in front the inventory report is usually correct--We can always get back in rather than holding and hoping gains hold on the way down.

Drugs: Got Anything Good in ... Stock Market Recap 06/12/15 ...