17Jun10:28 amEST

Bridge to Japan

I suppose all of the talk in recent years about the U.S. becoming Japan, in terms of "permanently" low interested rates and "zombie banks," may come to a head this afternoon, as we learn just how serious the Fed is about raising rates anytime this decade.

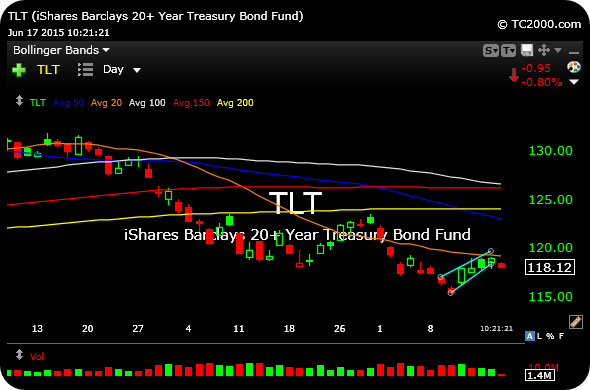

Treasuries have had a lackluster spring, using the TLT daily chart, below, as a proxy. We can plainly see the pattern of lower highs and lower lows by price, as yields climbed. After the likely initial whipsaw this afternoon, I am looking to see if bounces continued to get sold.

Regarding equities, TWTR still looks like a huge distraction to me as a trade, since there are plenty more intriguing setups out there. I sold the rest of my SWHC long in front of earnings tomorrow and may revisit that play, or RGR, soon.

And on the solar front, it is still a mixed space with broken and decent charts competing for control of the action. JKS looks to be as well set-up as any of them, as is TSL. CSIQ FSLR SCTY, on the other hand, still have some work to do to improve.

Stock Market Recap 06/16/15 ... Different Methods of Transpo...