17Jun3:18 pmEST

You Didn't Go to Rates Hell; You Went to Purgatory, My Friend

In the wake of the Fed this afternoon, markets have done their usual head-fake dance both ways. Beyond equities, we saw notable twists and turns in bonds, crude, natty, and metals.

All of this is happening as the U.S. Dollar plunges.

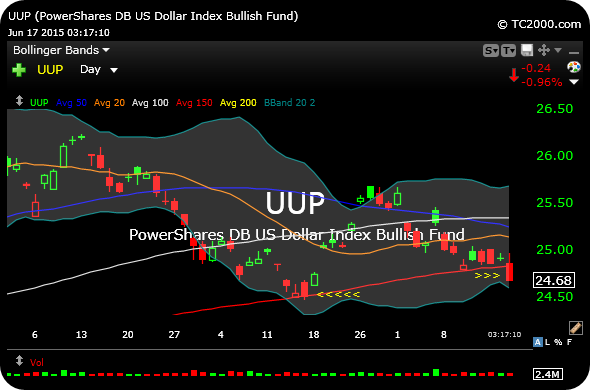

As we have been profiling, the 150-day moving average on the UUP ETF is noteworthy, due to the support found there for a strong bounce in May. This time around, however, as you can see on the updated daily chart, below, Dollar bulls failed to pack much of a punch.

At first blush, crude and natty are not celebrating the Dollar plunge very much, while metals are finally trying to get going. That said, TLT and rate-sensitive sectors like IYR XLU are hanging in rather well.

Different Methods of Transpo... Stock Market Recap 06/17/15 ...