16Jul3:05 pmEST

Smelling Blood in the Oily Water

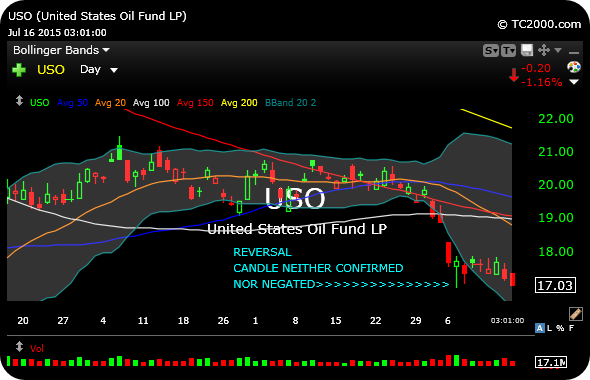

With crude oil's upside reversal candlestick last Tuesday not yet confirmed higher, you get the sense that oil bears are ready to sink their paws into trapped longs who have been rather complacently assuming a bottom in the energy complex for a while now.

Throughout today's session, crude has failed to hold bounces which looked somewhat promising overnight with the futures.

On the other hand, last week's reversal has not been soundly negated either, which would likely require a sharp plunge below $17 on the USO ETF, pictured below on the daily timeframe.

And thus we have the choppy action, a bit of a grind for both side of the trade today when you include the energy stocks in the OIH XLE ETFs, especially.

I scaled some profits inside Market Chess Subscription Services in a crude bearish ETF (DWTI), and am holding onto anther piece in the event crude does, actually, plunge this afternoon or overnight.

There may be blood in the water which crude bears have detected. But they had better pounce before the tide carries their prey away upstream.

Stretched Out After Earnings... Stock Market Recap 07/16/15 ...