05Aug12:43 pmEST

One More Strike May Lurk

As a general rule, markets which remain stubbornly oversold in the context of an established downtrend and fail to sustain even snapback rallies, when they appear that they should, are most at risk for a further wipeout.

Consistent with previous discussions, the inability of the energy sector and crude oil to hold bounces remains a lingering concern. Furthermore, there lack of general panic on the part of market players undermines the notion that energy is at one of those rare "buy the blood in the streets" moments for the complex.

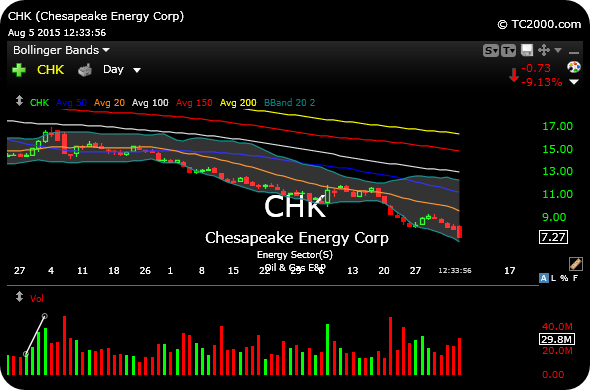

Indeed, there is little doubt that the action in FB NFLX PCLN of late, among others, has masked the red flags the energy complex has been waving, in terms of the traditional warning signs of a sector under several liquidation. CHK, for example, on the daily chart, below, is not even technically oversold here, according to Bollinger Band analysis.

And Chevron, a named we noted earlier, is simply "riding down" along its own lower Band which, again, displays a general lack of panic. Perhaps we would need to see a bankruptcy or some scary sharp downticks before at least a tradable bounce would be worth the time, capital, and summer energy.