14Aug10:24 amEST

Pondering a Surrender

The price action this week in the precious metals miners now compels us to consider whether what we saw in late-July, with violent selling after an orderly, steep move lower, was a form of capitulation from gold bugs who finally waved the white flag on their firmly held positions.

The counter-argument to the above point, which many gold bears have argued, is that there are still too many crazy-eyed gold bugs who have yet to admit the error in their ways, as the miners and metals remained mired in an established, multi-year bear market.

But that fails to take into account that capitulation may have occurred nonetheless, since gold bugs may have sold because they had to, not because they wanted to.

Whether this rally turns into a bear market bottom, or simply a quick, tradable bounce remains to be seen. All we can do is objectively gauge each pause and pullback, looking to see if buyers present themselves to from higher low after higher price low. We traded JNUG earlier this week inside Market Chess Subscription Services, and may look to reenter soon if the miners continue to consolidate in a benign manner and push higher yet.

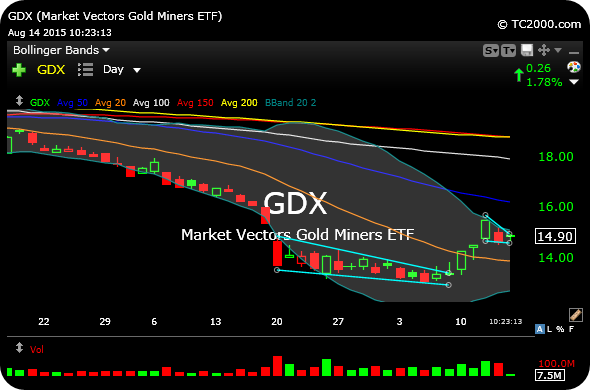

If the GDX, senior gold miner ETF on the daily chart, below, loses $14 then I suspect all bets are off and new lows may be in store. But, as you can see, so far the first pause has been innocent enough.

I am keying off premier miners such as ABX NEM RGLD SLW for clues, and juniors like AG HL.