28Aug12:51 pmEST

A Target for Oil

Into this snapback rally, it is still premature to declare any type of meaningful bottom, at least from a technical perspective.

It is worth noting that bear markets tend to feature some of the most powerful, spirited, hopefully, but ultimately short-lived rallies. The false hope is part and parcel of a manipulative bear still very much in control, sucking in bottom-fishing longs only to see the claws come out for another leg lower after the sharp squeeze abruptly heads south.

Now, newcomer shorts often see the rallies as a great way to pounce and play for a rollover, but a few sizable gaps higher like we have seen of late in crude tend to put them in their places, too.

Hence, day-trading and/or watching intently from the sidelines often provides the best entries for the patient.

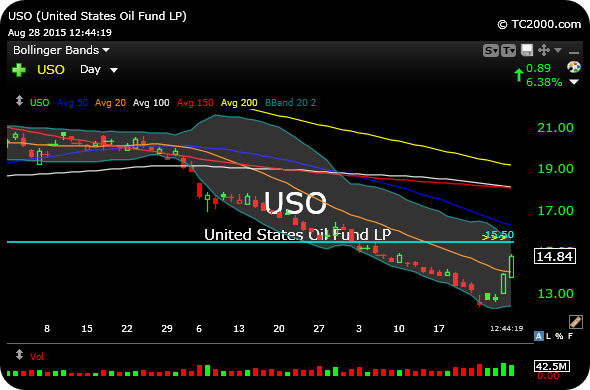

In the case of USO, the crude oil ETF, below on the daily chart, a move up to $15.50 makes sense, as that would coincide next week (or today, if the action gets even more violent to the upside) with the upper Bollinger Band, declining 50-day moving average, and some prior price memory.

Until then, shorts beware and longs should not overstay their welcome.

As for the market and commodities at-large, I will cover that for Members in my usual Midday Video, filming now.