09Sep12:23 pmEST

Weighing the Strength of This Bear

In front of the AAPL event at the top of the hour, equities actually flipped to red from the large gap higher at the open, before setting into a sideways range midday.

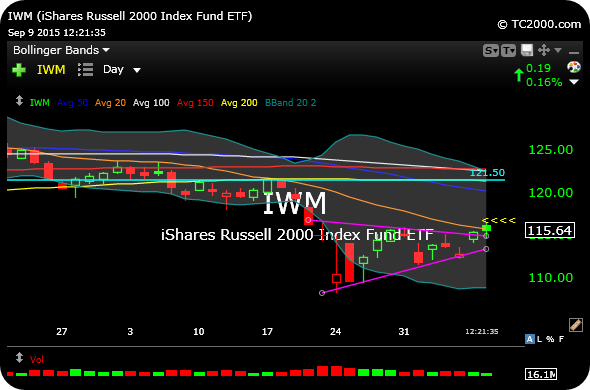

The Russell 2000 Index, see below on the ETF daily chart, offers a good litmus test as to how (imp)potent bears still are in this broad market structure, insofar as this being the first test of the 20-day simple moving average (orange line) since before the late-August range breakdown the market at-large experienced. Overall, we have many whipsaws across many asset classes today, with patience and under-trading still likely correct.

A squeeze into the bell is what bulls are counting on to continue a potential "pain trade" higher. But first things first, in terms of the 20-day moving average on the major indices needing to be cleared adequately.

Elsewhere, beyond the TTPH fiasco, biotechs in general are notably lagging the market today.