11Sep10:22 amEST

Not-So-Antiquated Dow Theory

At the beginning of the summer the persistent weakness in the Dow Jones transports was largely cast aside as being outdated. And the notion that the industrials and market at-large should follow the transports lower was eschewed, even mocked, by many a market player.

Fast forward to the sessions following Labor Day, and all major averages are operating below their respective 200-day simple moving averages, several of which are now sloping downwards.

We did not necessarily extrapolate a new bear market from the weakness in the transports. But we did monitor the weakness spreading to other parts of the market for Members, helping us to stay out of trouble over the summer.

Even with a reversion rally in recent weeks, the IYT, ETF for the transports, remains mired in a strong downtrend where the presumption is that rallies will be sold.

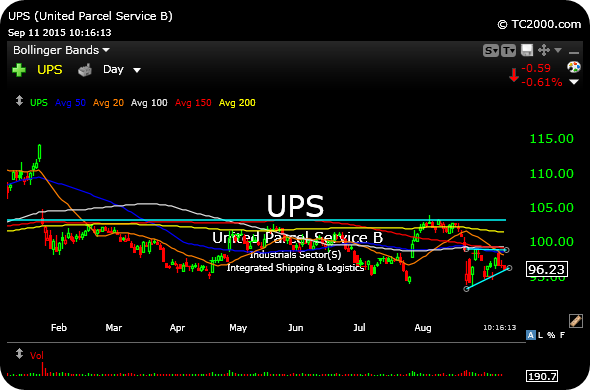

Beyond that, transport titans like UPS and UNP are still far from sporting discernible bottoming patterns.

UPS, for example, is still a broken chart with price under all moving averages, and a declining 200-day at that. The stock is weak, again, today, and looks to be ripe as a short if the broad market fails remains soft.

Overall, the transports have not made a new highs since November 2014. They could easily have been the canary in the coal mine this whole time, despite of (or perhaps because of) how many times they have been deemed irrelevant.

Going forward, if the market is bottoming then I would look to the transports, first, to see if any kind of tangible bottom is forming.

Stock Market Recap 03/25/15 ... Sliding Into an Obvious Base...