17Sep10:42 amEST

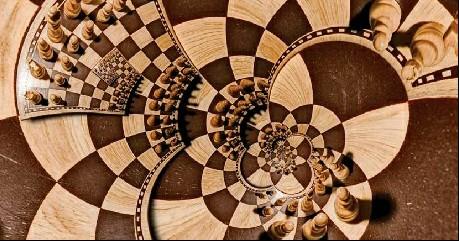

Complex Mind Games

Headed into the Fed later today, there are so many ways to try to predict what the Fed will do and, more importantly, how the market will react. As always, though, the market is the final arbiter and will determine the resolution.

The SPY, for example, an S&P 500 ETF, below, shows a "running" rising wedge higher after the late-August swoon.

Those wedges can keep running on higher, not necessarily needing to roll back over. But that is certainly the risk if the market hears anything it does not like today.

Amazon and the smaller cap biotechs are leading, while the semis are lagging.

Crude oil popped above yesterday's highs before coming back down to consolidate more.

On the private Twitter feed for Members this morning, I will be discussing which inter-market tickets to watch for "tells" after the FOMC Announcement.

A Toll Booth Willie Bull Mar... Stock Market Recap 06/08/17 ...