12Oct3:00 pmEST

Just When You Thought We Left City Limits...

Most commodities and materials miners today are taking a pounding today, driving home a pretty good lesson about bear market (as defined by a declining 200-day moving average and an overarching series of lower highs and lower lows by price) rallies.

Indeed, some of the most promising, spirited, violent rallies occur in bear markets, giving home to both bottom-fishing as well as those longs trapped from much higher prices.

But bear market rallies also end abruptly with without mercy, typically setting up a fresh move down to new lows.

In this scenario, though, commodities have already been in steep and established bears for quarters if not years on end. So, shorting today's weakness may also be a trap and part of a larger bottoming process, as some bulls are contending.

However, the larger point is to recognize the risks at the particular moment, such as with crude oil, as an example.

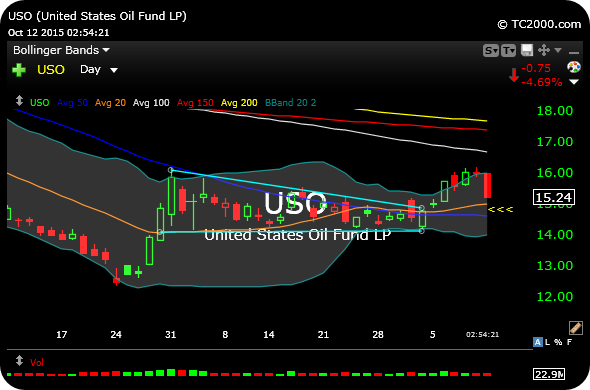

On the USO ETF daily chart, below, crude is coming in rather hard today off overbought conditions attained last week on the rally. If this is a mere shakeout and part of a bottoming process, that $15 area, just below, should serve its purposes of punishing latecomer longs while also trapping in shorts for a new leg higher or part of a larger bottoming formation sideways.

Below that 50-day moving average, at around $14.63 now, though, and I suspect new bear market lows would come for crude and perhaps all commodities, indeed trapping in the many cheerleading longs from last week's rally.

r

At Fourteen Hundred Ninety-T... Stock Market Recap 10/12/15 ...