14Oct10:19 amEST

TRIP or Treat

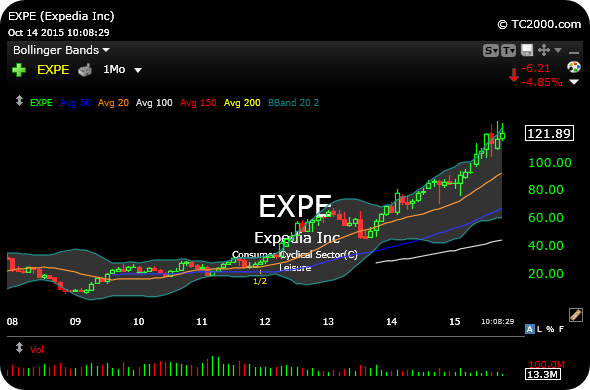

On the back of news about TripAdvisor (TRIP) and The Priceline Group (PCLN) forming a strategic partnership, competitor Expedia (EXPE) is selling off, down nearly 5% as I write this.

This type of event is a good example of what often happens in markets, as many are quick to point to a very convenient "catalyst" for the EXPE selling, declaring it to be a news-driven event.

However, inside Market Chess Subscription Services, we have recently been using EXPE as an example for Members of a daily chart which had looked firm, but the long-term timeframes were worrisome.

Specifically, EXPE has enjoyed a fairly steep long-term uptrend, which is all fun and games for longs until it breaks. And, regarding the PCLN TRIP news, that may very well have been an excuse--the one EXPE was waiting for---to eventually break trend and finally crack. In fact, as you can on the monthly, below, the uptrend may just be getting started in terms of a correction lower.

So it is certainly worth looking at stocks on multiple timeframes, especially in this market climate. And apparent news events may be mere excuses when viewed through this lens.

Earning are coming up at the of the month, around Halloween. Will if be TRIP or treat for EXPE?

Stock Market Recap 10/13/15 ... All in All, It's Just Anothe...