20Oct10:38 amEST

Trapped Deep Inside the Big Blue Grotto

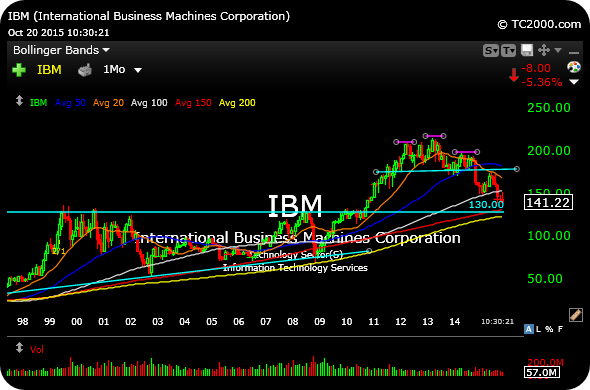

If you have been following the series of blog posts on IBM, not much has changed from a long-term perspective: "Big Blue" remains a classic value trap and has been for several years now.

The time to be bullish on IBM was back in the summer 2010, when the stock was bumping its head up against well-defined resistance all the while making higher lows dating back twelve years.

Currently, IBM is almost at the $130 target we have been expecting for a while now. At that point, one may consider a value play, but that would only be a hypothesis to evaluate and far from an actionable entry point.

Overall, not much has changed on the IBM monthly chart, updated below, from blog posts over the last few years. This is a confirmed top still playing out for a major market bellwether. At a minimum, newfound value investors are finding out just how many value traps may be lurking out there, and IBM could easily be just the tip of the iceberg.

Timeframe, of course, is key, as this is a long-term look, at odds with this morning's price action in, say, AAPL and the resilient small caps.

Still, value longs remain trapped deep inside the Big Blue grotto.

Stock Market Recap 10/26/17 ... Van Tharp on Position Sizing