23Oct3:23 pmEST

An Incestuous Relationship

Headed into the end of October, with the holidays rapidly approaching to wind down 2015, the interplay between the consumer discretionary and retail stocks is coming to the forefront of market issues in play.

Led by the mighty AMZN DIS HD MCD NKE SBUX, the XLY has led the broad market rally in October on many levels, never seeing the consumer discretionary ETF's 200-day simple moving average turn lower in that time (when many other indices and sectors did).

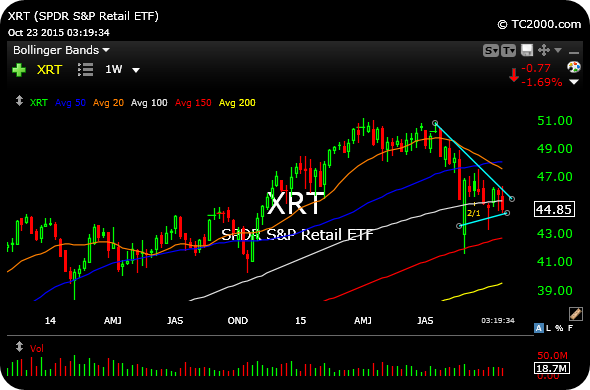

The XRT, on the other hand, has been much weaker. The retail sector ETF, below, would figure to have the same exposure to the consumer as the XLY, but clearly the price action is much more ominous. The weekly chart illustrates that point, continuing to lag the market rally today and perhaps ripe to break lower yet.

Even NFLX, a top ten XRT holding, being up 3% today, failed to inspire a rally.

Headed into the final two months of the year, I expect the spread between the XLY and XRT to reach a tipping point, with looming DIS HD SBUX earnings likely to make or break the divergence.

A Setup at the Cuban Cigar S... Perspective Before the Ride ...